1. Introduction

In an economy that leans heavily on the specialized skills of subcontractors, understanding the role and benefits of Workers Compensation Insurance for Subcontractors is critical. This specialized form of insurance represents a critical safeguard, one that ensures the stability and continuance of subcontractors’ operations in the face of workplace incidents. Tailored to meet the unique needs of subcontractors, this insurance is not merely a regulatory formality; it’s an essential component of a robust risk management strategy.

2. Understanding the Subcontracting Sector

Subcontracting is integral to several industries, supporting larger businesses by providing specialized skills and services. Yet, subcontractors encounter distinct challenges, mainly due to their often-temporary employment status and the need to jump from one project to another, which can leave them exposed to varied workplace hazards. The financial repercussions of workplace accidents are amplified for subcontractors who typically operate without the safety nets available to full-time employees of larger firms. Hence, mitigating financial risks is not just prudent; it’s central to their professional survival.

Understanding the subcontracting sector’s dynamics is crucial for appreciating the need for specialized insurance solutions. Organizations such as the Associated General Contractors of America offer resources that highlight the unique challenges faced by subcontractors, including insurance needs.

3. The Role of Workers’ Compensation Insurance in Protecting Subcontractors

Traditionally, workers compensation insurers have focused on providing coverage for employees within larger corporations. For subcontractors, however, workers’ compensation insurance plays a different, yet equally vital role. It functions as a standalone shield against the financial strife that can ensue from an injury or accident on the job. More than merely a way to cover medical bills, this insurance helps maintain the financial underpinnings of the subcontractor’s business in the aftermath of an incident.

For an in-depth explanation of how workers’ compensation insurance applies to subcontractors, the Independent Contractors and Businesses Association offers a wealth of information, as well as advice on navigating the complexities of this essential coverage.

4. Benefits of Workers’ Compensation Insurance to Subcontractors

The advantages of workers’ compensation insurance for subcontractors are diverse and far-reaching. Key among these benefits is coverage for medical expenses arising from work-related injuries or illnesses, including hospitalization, surgical procedures, and medications. It also provides compensation for lost wages, helping injured workers maintain financial stability during their recovery period.

An often-overlooked aspect is the protection it affords against potential legal action. In the event of workplace injuries, employees typically receive benefits without the need for costly and time-consuming litigation. This can be a lifesaver for subcontractors who may not have the financial means to withstand prolonged legal battles.

The Occupational Safety and Health Administration (OSHA) provides further insight into the requirements and benefits of workers’ compensation insurance, helping subcontractors understand the protections afforded to them and their employees.

5. Real-world Examples

Consider the example of a construction subcontractor who experiences an electrical accident. With workers’ compensation insurance, the individual not only received coverage for emergency treatment and ongoing physiotherapy but also a portion of their salary during the recuperation period. Another instance involves a freelance consultant who developed carpal tunnel syndrome as a result of their work. Their workers’ compensation insurance covered corrective surgery and provided financial support while they were unable to work.

Stories like these, which can be found through various industry reports and case studies, underscore the tangible benefits of having a comprehensive workers’ compensation policy in place.

6. What to Consider When Choosing Workers’ Compensation Insurance as a Subcontractor

When selecting a workers’ compensation insurance policy, subcontractors should carefully evaluate the terms and extent of coverage against the particular risks of their profession. They must also balance the cost of premiums against potential benefits, ensuring that the policy is both affordable and adequate. The reputation and reliability of the insurance provider should also be a factor in the decision-making process.

Subcontractors should familiarize themselves with the legal requirements surrounding workers’ compensation insurance in their specific region, as these can vary significantly. Each state has its own Workers’ Compensation Board or equivalent authority, and these entities provide comprehensive guidelines on the statutory requirements.

For example, the California Department of Industrial Relations offers a resource for employers, including subcontractors, to understand their obligations regarding workers’ compensation insurance in California.

7. Common Misconceptions about Workers’ Compensation Insurance

One prevalent misconception is the belief that workers’ compensation insurance is unnecessary for subcontractors who don’t employ a team. However, even solo subcontractors can benefit from this insurance to cover themselves against potential work-related injuries or illnesses. Additionally, some subcontractors mistakenly think that personal health insurance or disability insurance can fully substitute for workers’ compensation insurance, which is not the case, as they provide different benefits and protections.

To dispel these myths and provide accurate information, organizations such as the Insurance Information Institute offer resources that clarify the purpose and importance of workers’ compensation insurance for all types of employment, including subcontracting.

8. Conclusion

Workers’ compensation insurance for subcontractors is not just another bureaucratic requirement—it’s a critical component of a sustainable business model in sectors that rely heavily on subcontracted labor. This insurance is a must-have for subcontractors, offering them and their employees protection in the event of an unexpected workplace injury and ensuring their financial resilience.

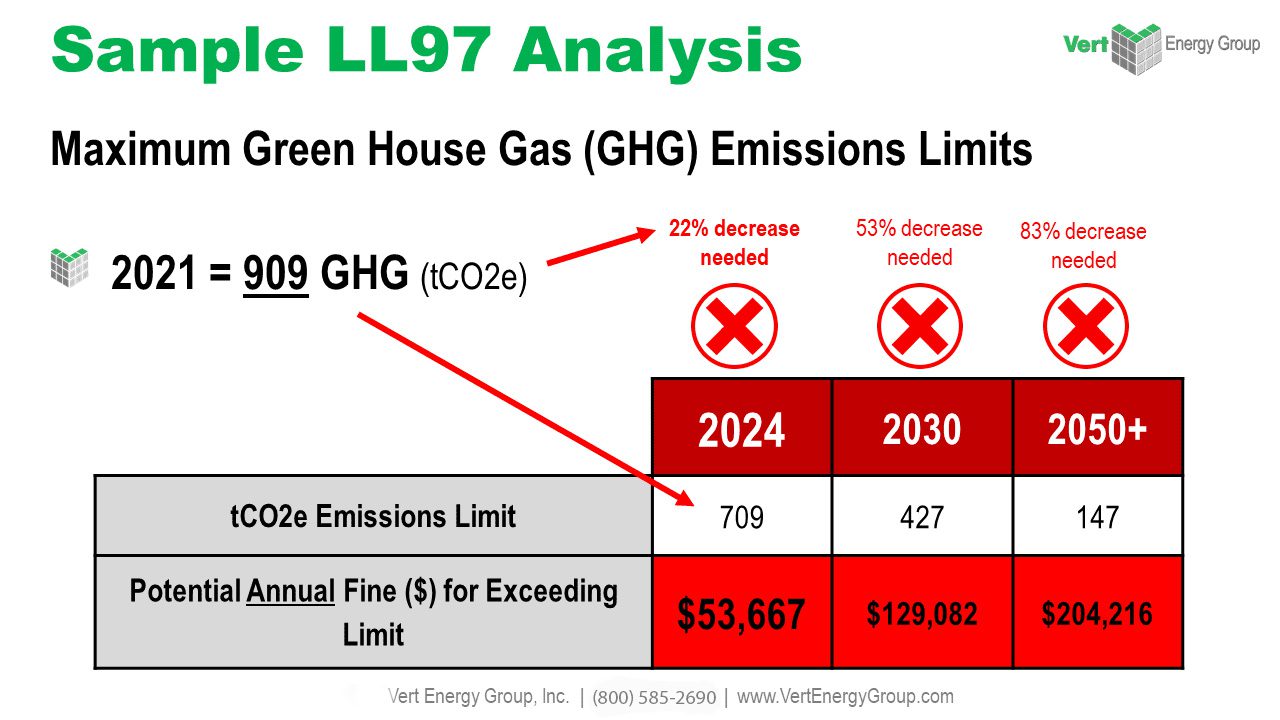

VertPro.com is the go-to hub for contractors dedicated to elevating energy performance upgrades for their clients. Our expansive suite of offerings includes expert Commercial Energy Audits, adept Benchmark Compliance consultation, and expansive Construction Marketplace. At VertPro®, we pride ourselves on delivering cutting-edge SaaS technology solutions that simplify the journey through Energy Benchmarking, and Energy Audits/RCx Plus, all while maintaining full compliance with a myriad of more than 60 Energy Benchmarking and Energy Efficiency Regulations nationwide.

At VertPro.com, we don’t just provide the insights and tools for energy management; we also bridge connections between qualified contractors and our client base, eager to upgrade their buildings. This creates a Marketplace where you can expand your project portfolio, ensuring that you’ll have more opportunities to apply your skills and grow your business.