Introduction

In the complex landscape of construction projects, managing risks associated with subcontractors is crucial. Subcontractor Default Insurance (SDI) emerges as a pivotal tool, designed to shield construction projects from the financial turmoil and delays associated with subcontractor failures. This blog delves deep into the concept of SDI, contrasting it with traditional surety bonds, and exploring its integral role in fortifying projects against the unpredictable nature of subcontractor defaults. Whether you are a project owner, a general contractor, or someone involved in construction risk management, a thorough understanding of SDI is essential for maintaining the stability and continuity of your construction endeavors.

Section 1: Understanding Subcontractor Default Insurance

What is Subcontractor Default Insurance?

Subcontractor Default Insurance (SDI) is a specialized form of insurance that provides general contractors with coverage against losses resulting from a subcontractor’s failure to fulfill their contractual obligations. This insurance is crucial in construction, where the chain of dependency is significant, and the failure of one subcontractor can lead to cascading delays and financial losses.

SDI vs. traditional surety bonds: key differences

Traditional surety bonds involve a three-party agreement – the principal (subcontractor), the obligee (project owner), and the surety, who guarantees the project’s completion should the principal fail to meet their obligations. In contrast, SDI is a two-party contractual agreement between the insurer and the insured (general contractor), which does not involve the project owner directly. One of the key advantages of SDI over surety bonds is the control it offers to the general contractor over the recovery process following a subcontractor default, potentially leading to quicker project continuity and reduced administrative overhead. For more insights on the differences, here’s an informative comparison.

Introduction to the need for SDI in construction projects

The construction sector is inherently risky, particularly due to the reliance on multiple subcontractors who may face their own challenges and instabilities. SDI addresses these vulnerabilities by providing a financial safety net, ensuring that the general contractor can manage and mitigate the impacts of defaults without jeopardizing the overall project timeline and budget.

Section 2: Importance of SDI in Construction Projects

The role of SDI in safeguarding construction projects

SDI serves as a critical risk management strategy, protecting the project from severe financial strain caused by subcontractor failures. In the event of a default, the insurance covers direct costs needed to complete the subcontractor’s scope of work, including the expenses of selecting and mobilizing a replacement subcontractor.

Cost implications associated with subcontractor default

The financial repercussions of a subcontractor default can be extensive, including the costs to rectify defective work, complete unfinished tasks, and cover legal fees or penalties for project delays. SDI helps absorb these costs, which might otherwise have to be borne out-of-pocket by the general contractor, thereby safeguarding the project’s financial health and continuity. Understanding these cost implications is crucial, and this resource provides further details.

How SDI helps limit potential losses

By offering immediate financial resources and support in the event of a subcontractor default, SDI significantly reduces downtime and helps keep the project on schedule. This prompt response is imperative to maintaining project momentum and adherence to predetermined timelines and budgets.

Section 3: Benefits of SDI

Detailed examination of the benefits of SDI

– Financial protection: SDI covers the unforeseen costs arising from a subcontractor’s default, ensuring that the project remains financially viable.

– Timeliness of project completion: By facilitating quicker responses to subcontractor defaults, SDI helps maintain the project schedule, which is often tightly linked to financial bonuses and penalties.

– Improved risk management: With SDI, contractors gain an enhanced ability to control and mitigate risks associated with subcontractor reliability throughout the project lifecycle.

Section 4: Limitations and Potential Drawbacks of SDI

Situations where SDI might not be beneficial

For smaller projects or those involving less risk from subcontractors, the cost of securing SDI might not justify the benefits, as the likelihood and impact of subcontractor defaults could be minimal.

Potential drawbacks

– Costly premiums: The premium costs for SDI can be high, reflecting the substantial risks and potential payouts associated with subcontractor defaults.

– Stringent qualification criteria: Insurers carefully assess the risk profile of a project and the general contractor’s historical performance before issuing SDI policies, which might exclude some applicants.

– Limited coverage in certain situations: SDI policies come with specific exclusions and limitations, which need to be clearly understood to evaluate their effectiveness in risk mitigation.

Section 5: Selecting the Right SDI for Your Needs

Factors to consider when choosing an SDI provider

Selecting the right SDI provider involves assessing their market reputation, financial stability, and the comprehensiveness of their coverage. It’s crucial to partner with a provider that understands the nuances of the construction industry and offers tailor-made solutions for your specific project needs.

Tips for negotiating terms of SDI

When negotiating the terms of an SDI policy, it is important to compare offers from multiple insurers and to understand each policy’s terms and conditions thoroughly. Focus on aspects such as coverage limits, exclusions, deductible amounts, and the claims process.

Importance of understanding the fine print

A deep understanding of your SDI policy’s fine print is essential to avoid surprises during a claim. This includes knowing what triggers coverage, the documentation required to support a claim, and any exclusions that limit the scope of the policy.

Conclusion

Subcontractor Default Insurance is a vital component of risk management in construction projects. By providing robust financial protection and facilitating the timely completion of projects, SDI plays a crucial role in ensuring that construction projects meet their deadlines and budgetary goals. As with any insurance product, the key to maximizing its benefits lies in selecting the right provider, negotiating favorable terms, and thoroughly understanding the coverage details. For construction managers and general contractors, incorporating SDi into their risk management strategies can mean the difference between a project’s success and failure. As the construction industry continues to evolve, the role of SDI will likely become even more significant, reinforcing its status as an indispensable tool in construction project insurance.

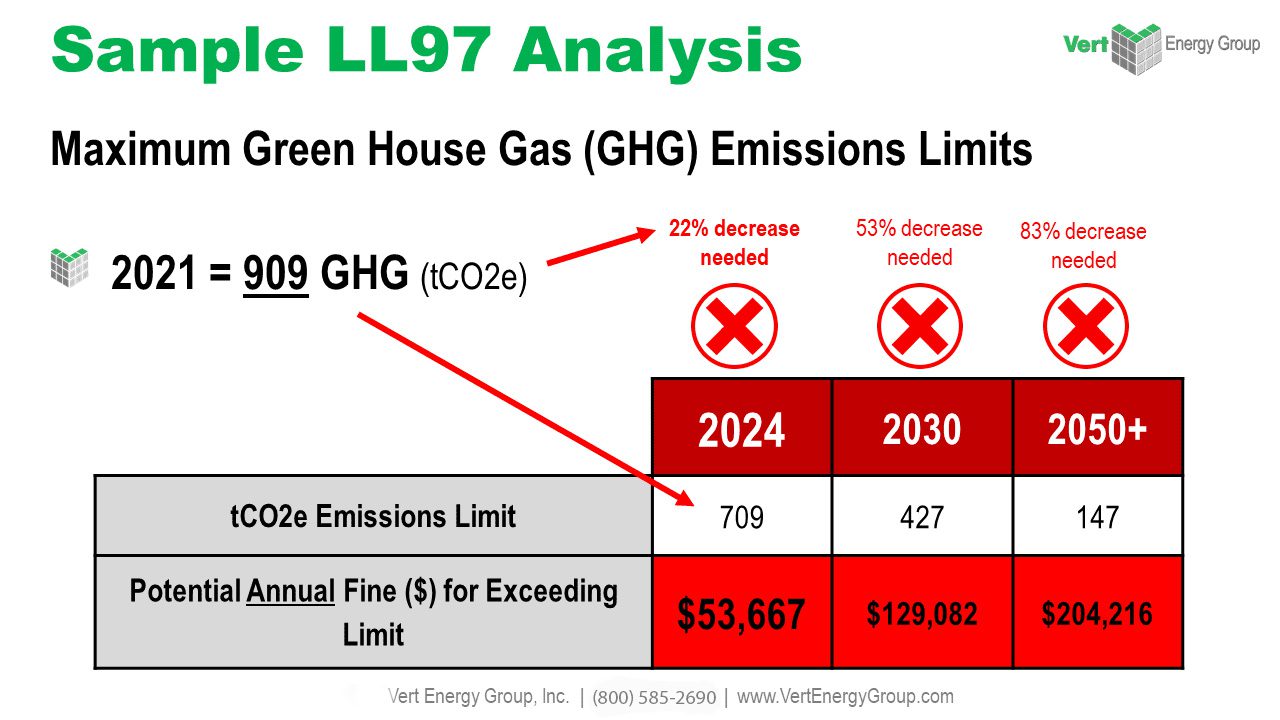

VertPro.com is the go-to hub for contractors dedicated to elevating energy performance upgrades for their clients. Our expansive suite of offerings includes expert Commercial Energy Audits, adept Benchmark Compliance consultation, and expansive Construction Marketplace. At VertPro®, we pride ourselves on delivering cutting-edge SaaS technology solutions that simplify the journey through Energy Benchmarking, and Energy Audits/RCx Plus, all while maintaining full compliance with a myriad of more than 60 Energy Benchmarking and Energy Efficiency Regulations nationwide.

At VertPro.com, we don’t just provide the insights and tools for energy management; we also bridge connections between qualified contractors and our client base, eager to upgrade their buildings. This creates a Marketplace where you can expand your project portfolio, ensuring that you’ll have more opportunities to apply your skills and grow your business.