The Shift To BPS: What’s Changing & What You Need To Know

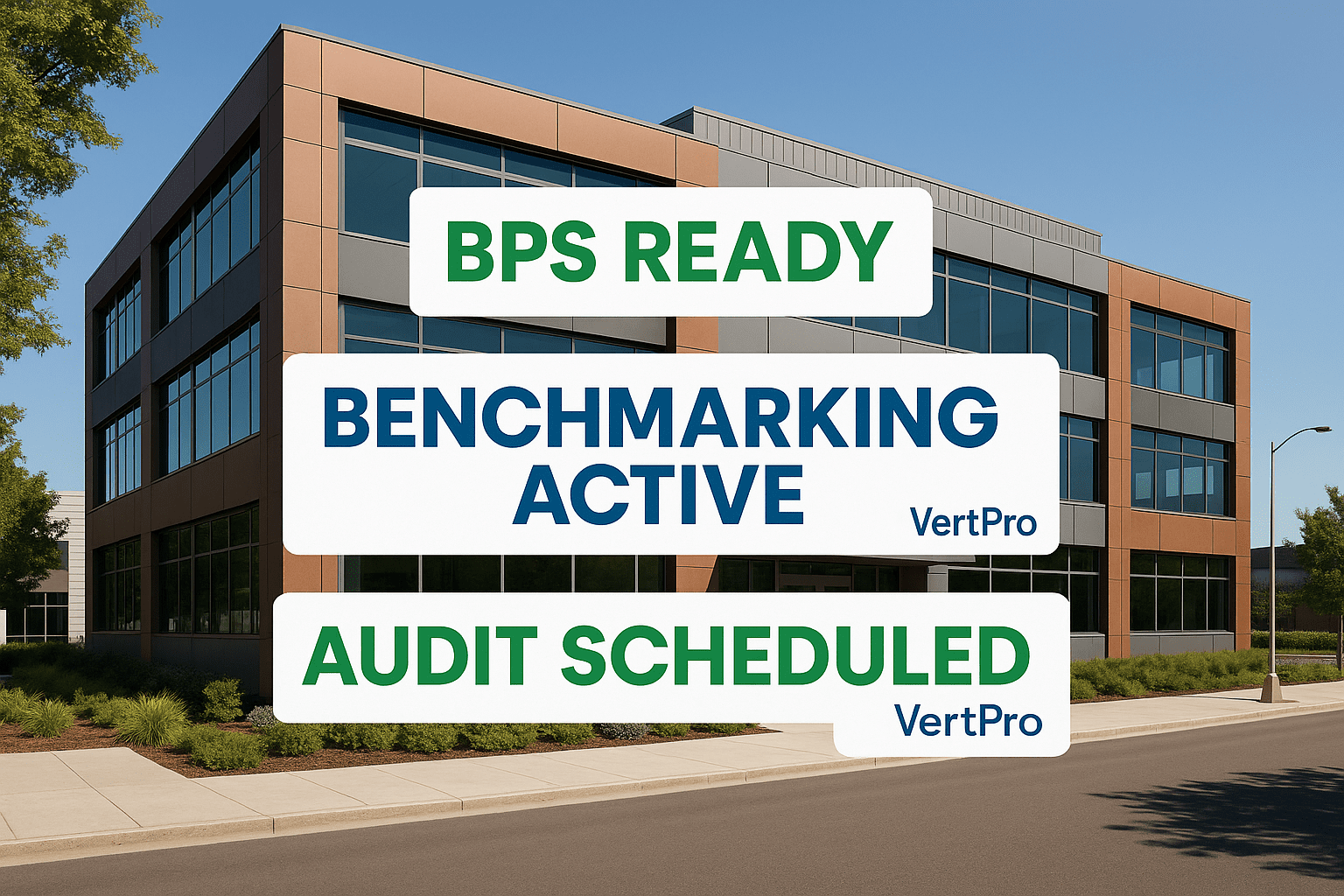

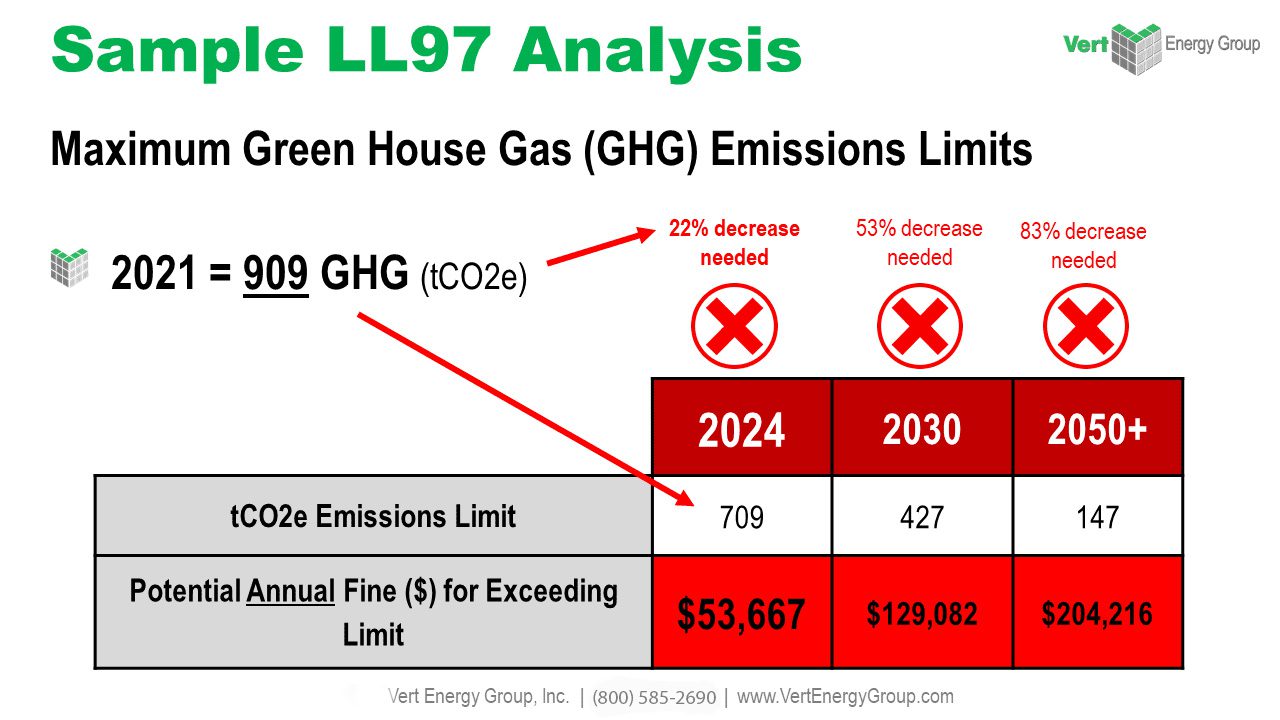

Building Performance Standards (BPS) represent a fundamental shift from traditional benchmarking to enforced performance thresholds. Unlike benchmarking, which focuses on reporting energy data, BPS requires property owners to actively improve building performance or face penalties. States like New York, Washington, and Massachusetts have already launched BPS programs, while jurisdictions like Colorado, Maryland, and D.C. will roll theirs out by 2026. With over 60% of U.S. commercial square footage projected to fall under BPS rules by 2030, ignoring this trend is a risk no owner can afford.

To stay compliant, and competitiv, building owners must act now. That means understanding which jurisdictions apply to your portfolio and what steps are needed to prepare. A risk assessment can identify exposures, opportunities, and a timeline for bringing properties up to standard. The earlier you plan, the more flexibility and financial advantage you gain.

Benchmarking’s Real Payoff: Improved NOI

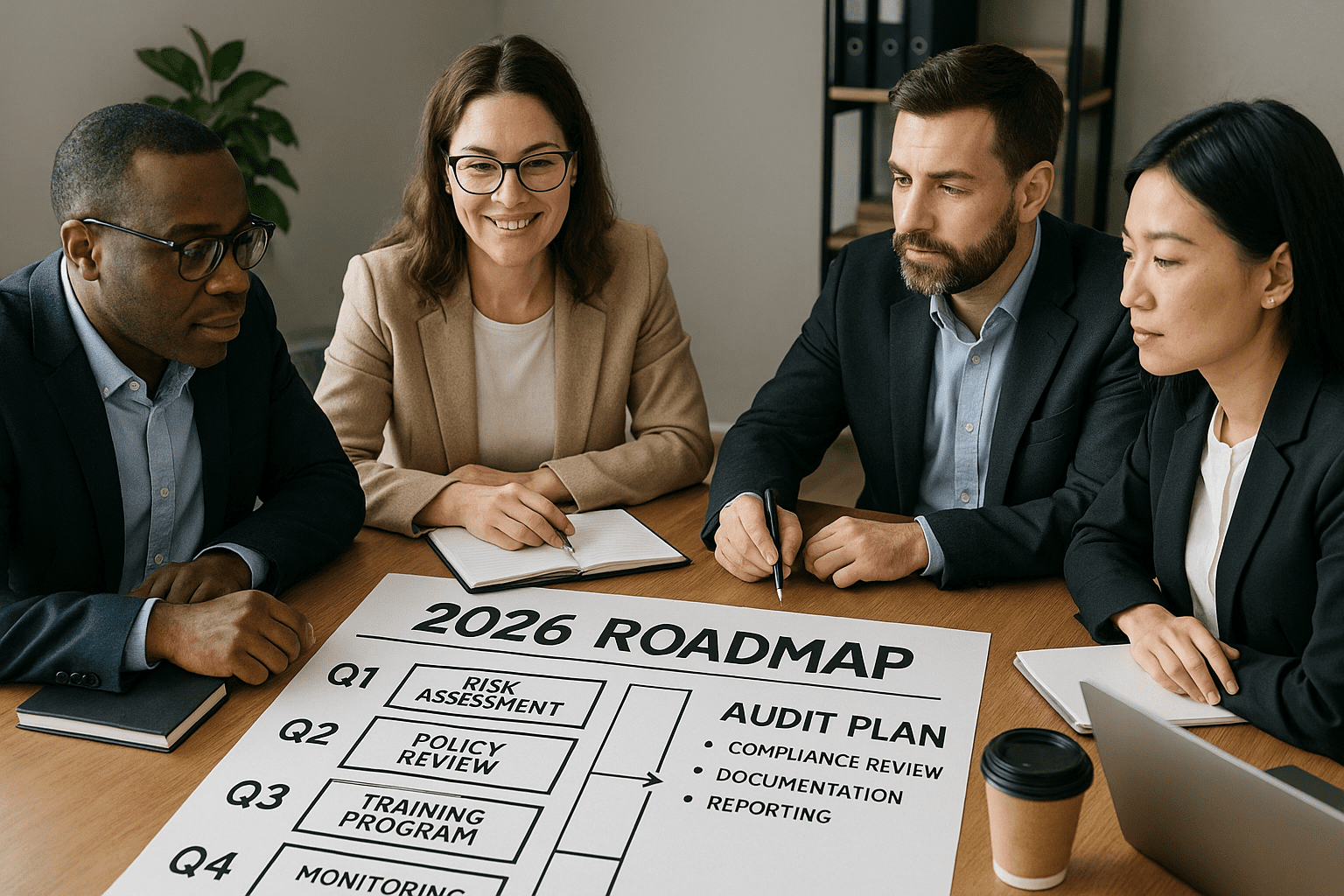

Benchmarking is a strategic tool that reveals hidden inefficiencies and trims energy waste. Buildings that regularly track and analyze energy use can reduce annual utility costs by 10–15%, which directly impacts their bottom line. Even a 5% drop in energy expenses can raise a property’s value by 1–2%, making benchmarking one of the most accessible ways to enhance NOI. When consistently applied, it becomes a long-term financial lever, not just a reporting requirement.

The sooner you implement or refresh your benchmarking process, the faster you can identify savings opportunities. And in markets with rising energy costs and tighter regulations, data-driven insight gives owners an edge. Benchmarking also builds a compliance history that supports future rebates, BPS readiness, and tenant retention. It’s a low-cost, high-return move that keeps paying off year after year.

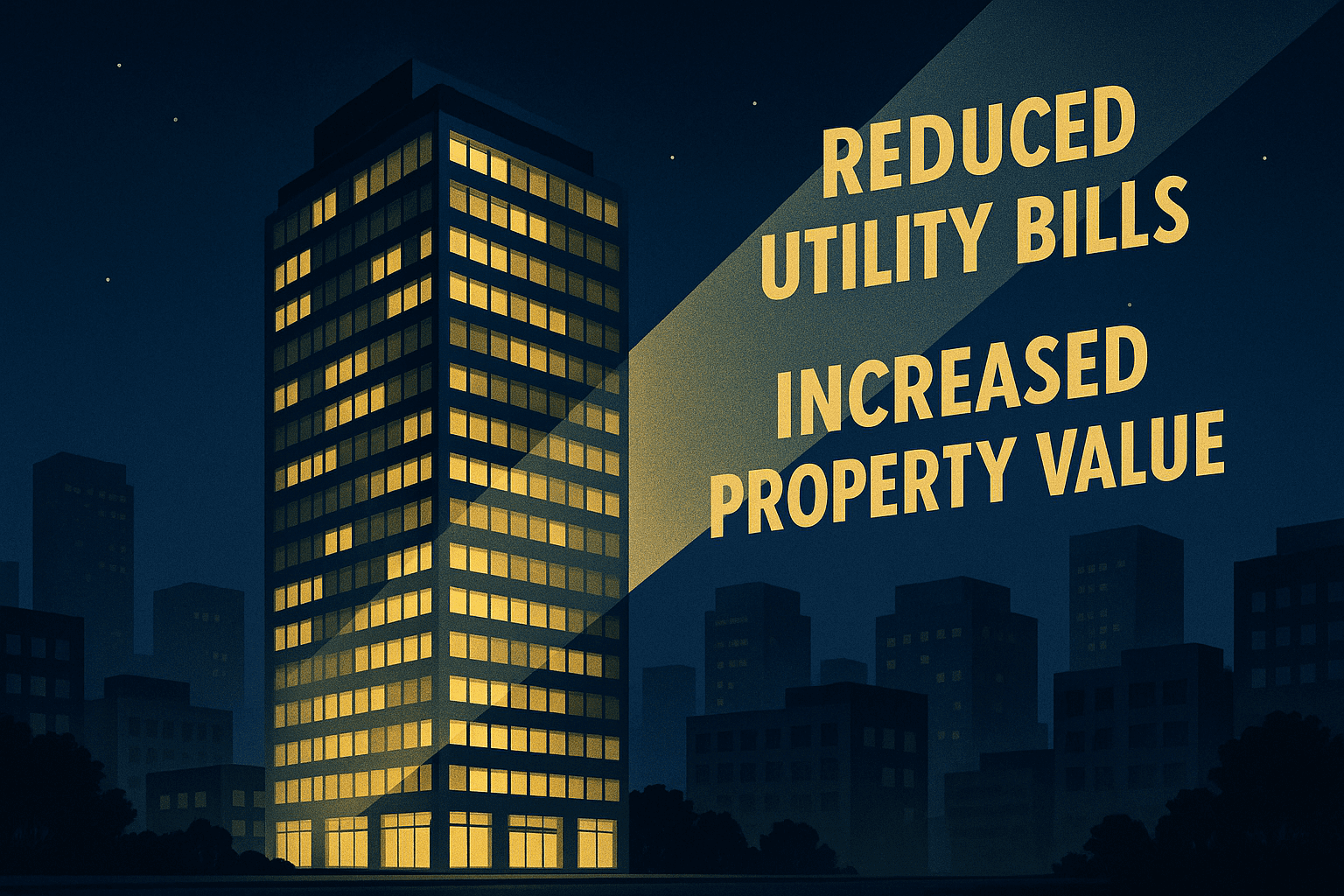

Energy Audits: Act Fast Before Deadlines Hit

With year-end approaching, many jurisdictions are enforcing energy audit deadlines, and missing them can be costly. Los Angeles has a firm EBEWE deadline of December 1, while New York City continues to require audits under LL87. Looking ahead, early 2026 brings the next audit phase for San Francisco and the first deeper performance audits in San Jose. Delay now, and you risk higher costs, fewer available audit firms, and even non-compliance penalties.

Audit slots fill fast, especially in Q1 when owners rush to catch up. Booking early ensures you meet deadlines and get full value from your audit, including identifying upgrades that could qualify for rebates. Energy audits aren’t just obligations; they’re insight tools that highlight where to improve efficiency and NOI. Secure your spot now to stay compliant and avoid a scramble in January.

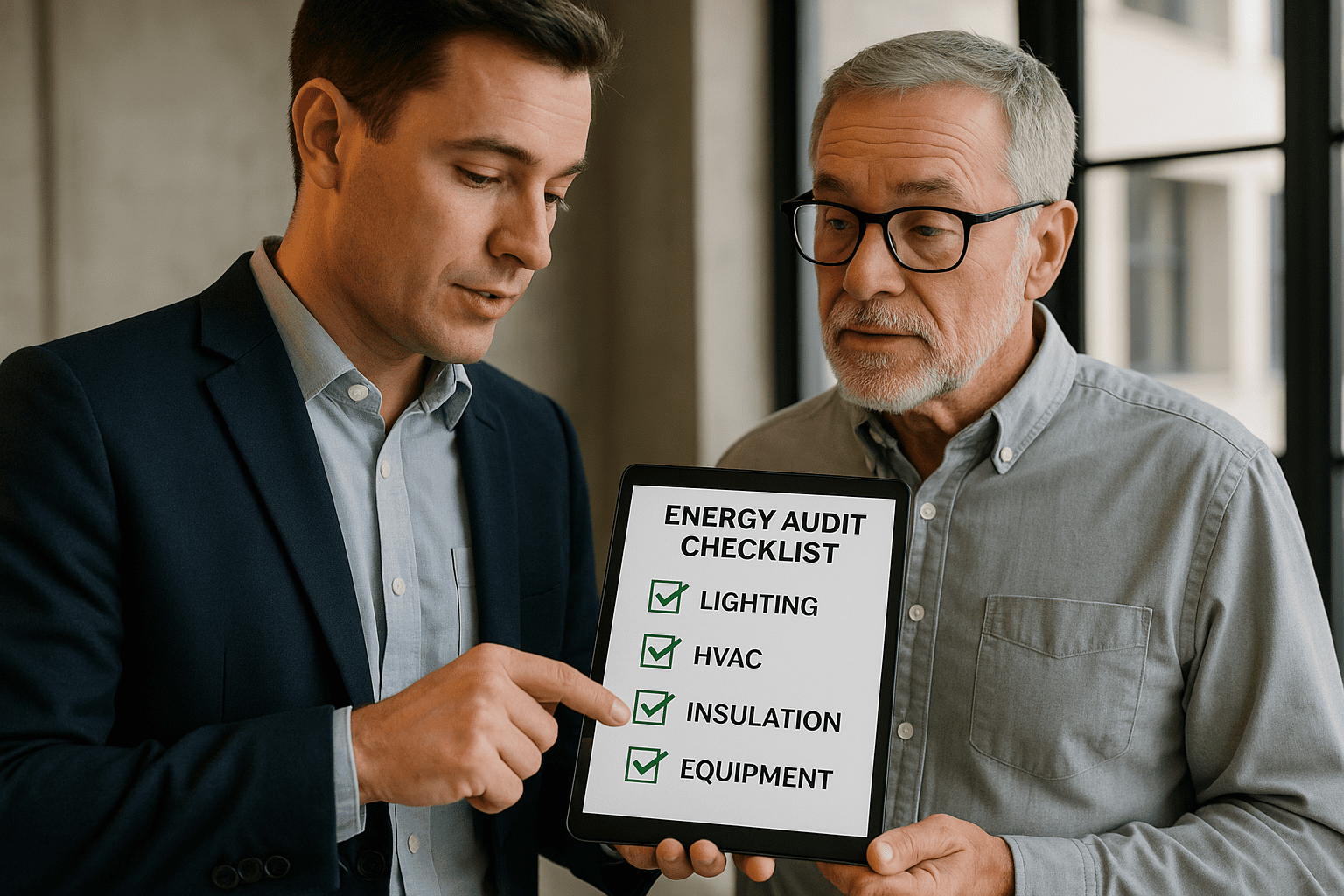

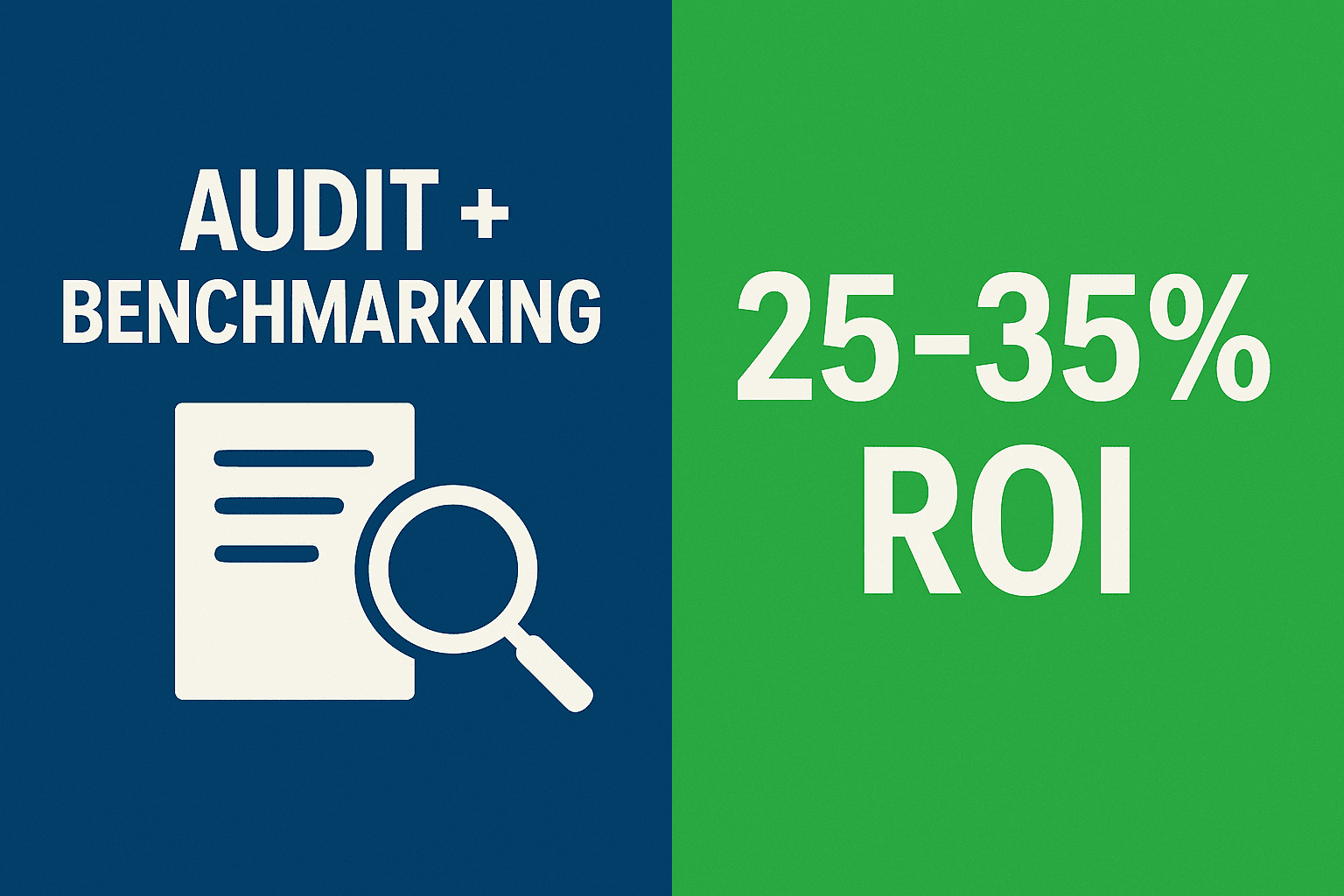

Turning Compliance Into Measurable ROI

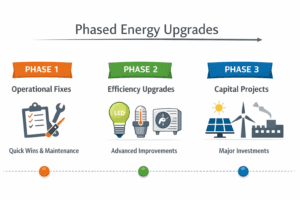

When approached strategically, energy benchmarking and audits unlock significant ROI. Properties that combine both see average returns of 25–35% within two years, thanks to data-driven upgrades like LED lighting, smart HVAC, and automation. Even better, many utilities and municipalities offer generous incentives to help fund the improvements identified in audits. Instead of viewing compliance as a cost center, it becomes a revenue-enhancing opportunity.

Acting early puts you in a stronger position to access these funds, avoid regulatory rushes, and implement changes at your own pace. It also lets you prioritize the most impactful upgrades, the ones with quick paybacks and tenant appeal. Whether it’s rebates, energy savings, or higher building value, compliance done right brings measurable returns. VertPro® helps you align timing, upgrades, and funding for the best financial results.

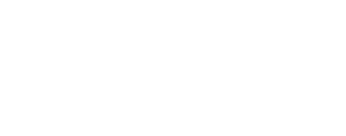

🧑💼 Why VertPro® Is the Partner You Need for 2026

With energy laws evolving and BPS requirements tightening, coordinating compliance across jurisdictions is more complex than ever. VertPro® simplifies it with one powerful platform for managing benchmarking, audits, and long-term BPS strategy. With over 8,000 successful audits completed and coverage in 50+ U.S. cities, our team brings both local insight and national scale. Whether you manage a single building or an entire portfolio, we customize a plan that keeps you ahead of the curve.

What sets VertPro® apart is our focus on ROI, not just checklists. Our advisors guide you through every step, from data submission to capital planning, with compliance deadlines and incentive windows built into your plan. As we head into 2026, early preparation means fewer surprises and stronger financial results. Let’s make your 2026 compliance strategy seamless, stress-free, and profitable.

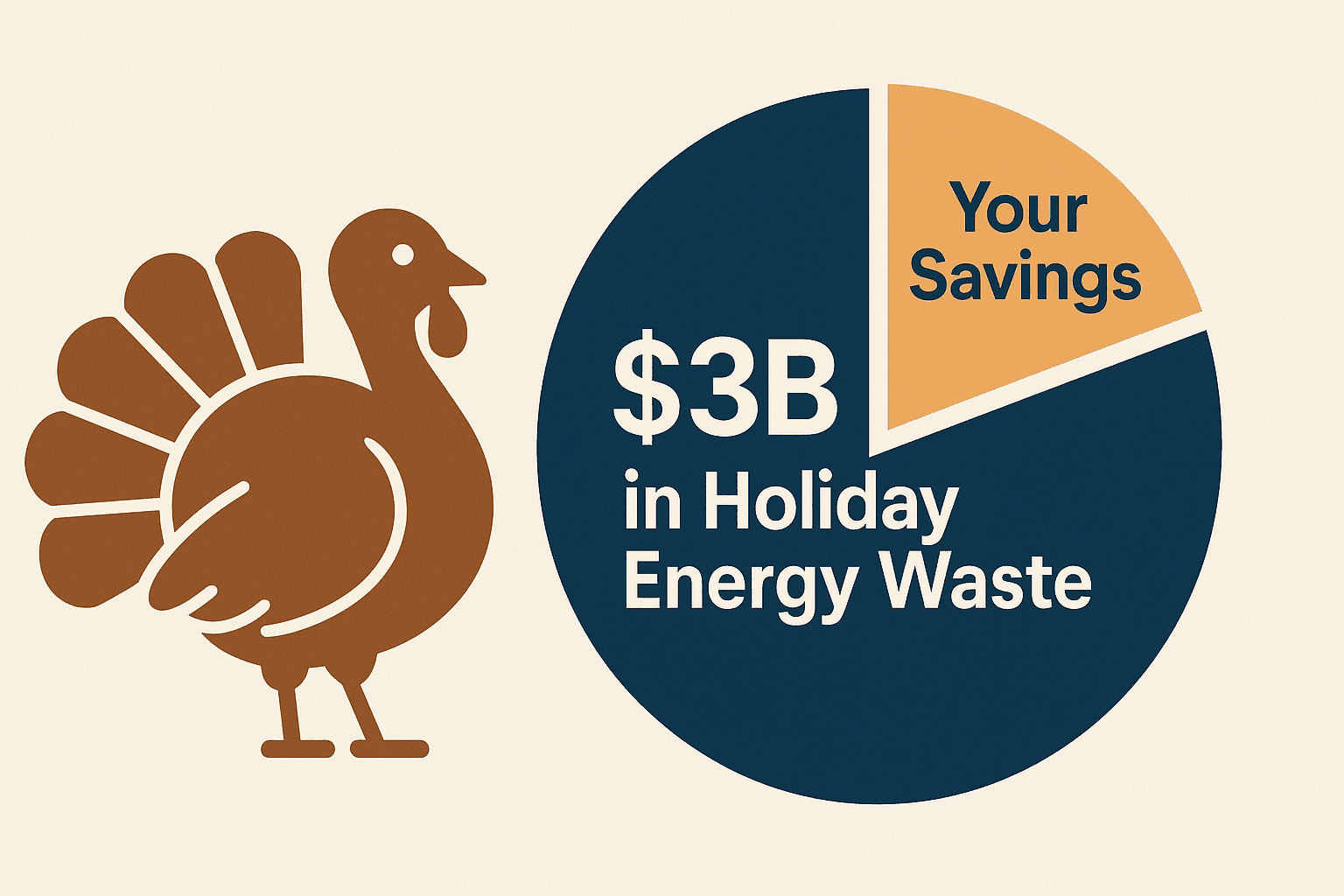

🦃 Thanksgiving Energy Tips: Save While You’re Away

As offices empty out, simple steps like adjusting HVAC settings, turning off lights, and unplugging idle electronics can prevent costly utility spikes. Many buildings run on autopilot during holidays, wasting thousands in phantom loads and inefficient operations. Taking a few moments to plan ahead means more money saved, and fewer surprises on your December bills.

With an estimated $3 billion wasted during holiday periods in the U.S., building owners who prepare in advance see noticeable savings. Update building control systems, confirm holiday setback schedules, and communicate energy-saving tips to your staff. A quick walkthrough can catch issues before they drain your budget. Make efficiency part of your holiday routine and keep your building performing even when no one’s around.