Energy Benchmarking Errors That Put Your Portfolio At Risk

Energy benchmarking is often treated as a simple reporting task. Owners collect utility data, enter numbers into a platform, and submit before the deadline. On the surface, it looks straightforward.

In reality, energy benchmarking errors are one of the biggest hidden compliance risks for building owners. Small mistakes can lead to inaccurate reports, failed audits, and penalties that show up months or even years later.

This article breaks down the most common benchmarking compliance mistakes, why they happen, and how to fix them before they create portfolio-wide risk.

Why Benchmarking Errors Are A Serious Compliance Problem

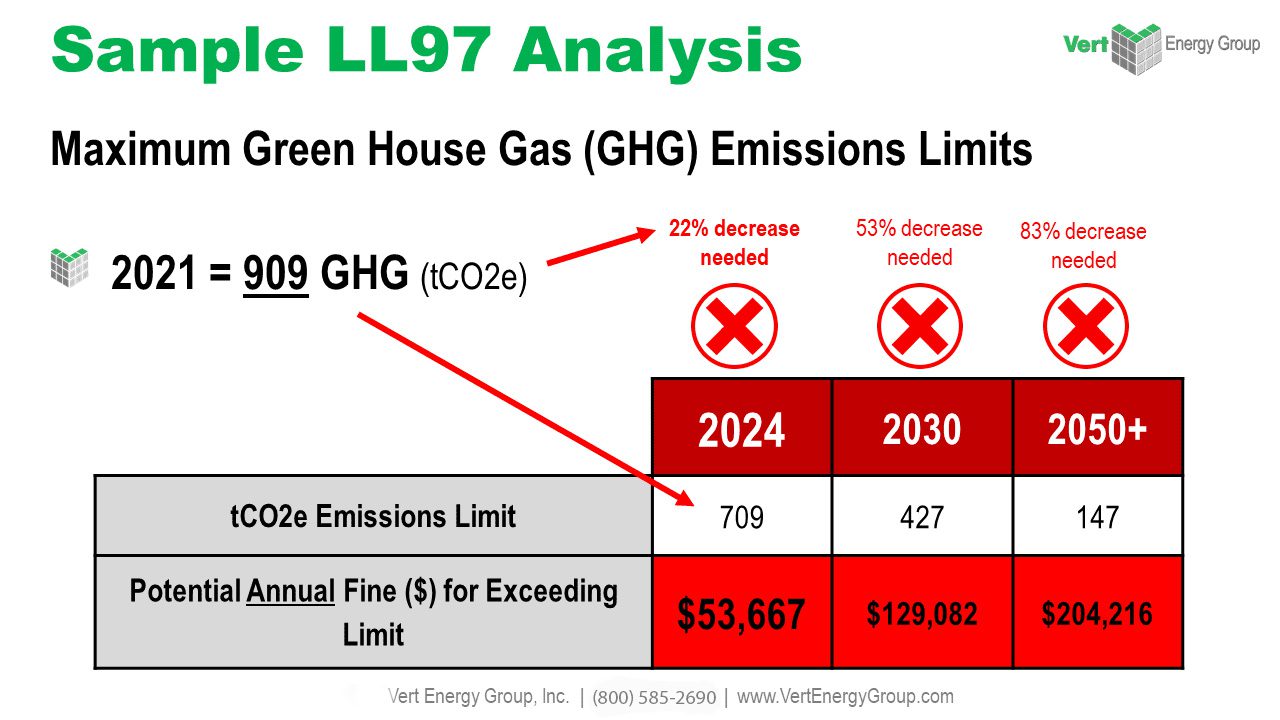

Benchmarking is the foundation of many energy laws. Cities and states use benchmarking data to set baselines, track progress, and determine enforcement.

When that data is wrong, everything built on top of it is also wrong. That includes audits, performance targets, and compliance plans.

This is why benchmarking compliance mistakes carry more risk than most owners realize. A single incorrect submission can trigger penalties or force costly corrections later.

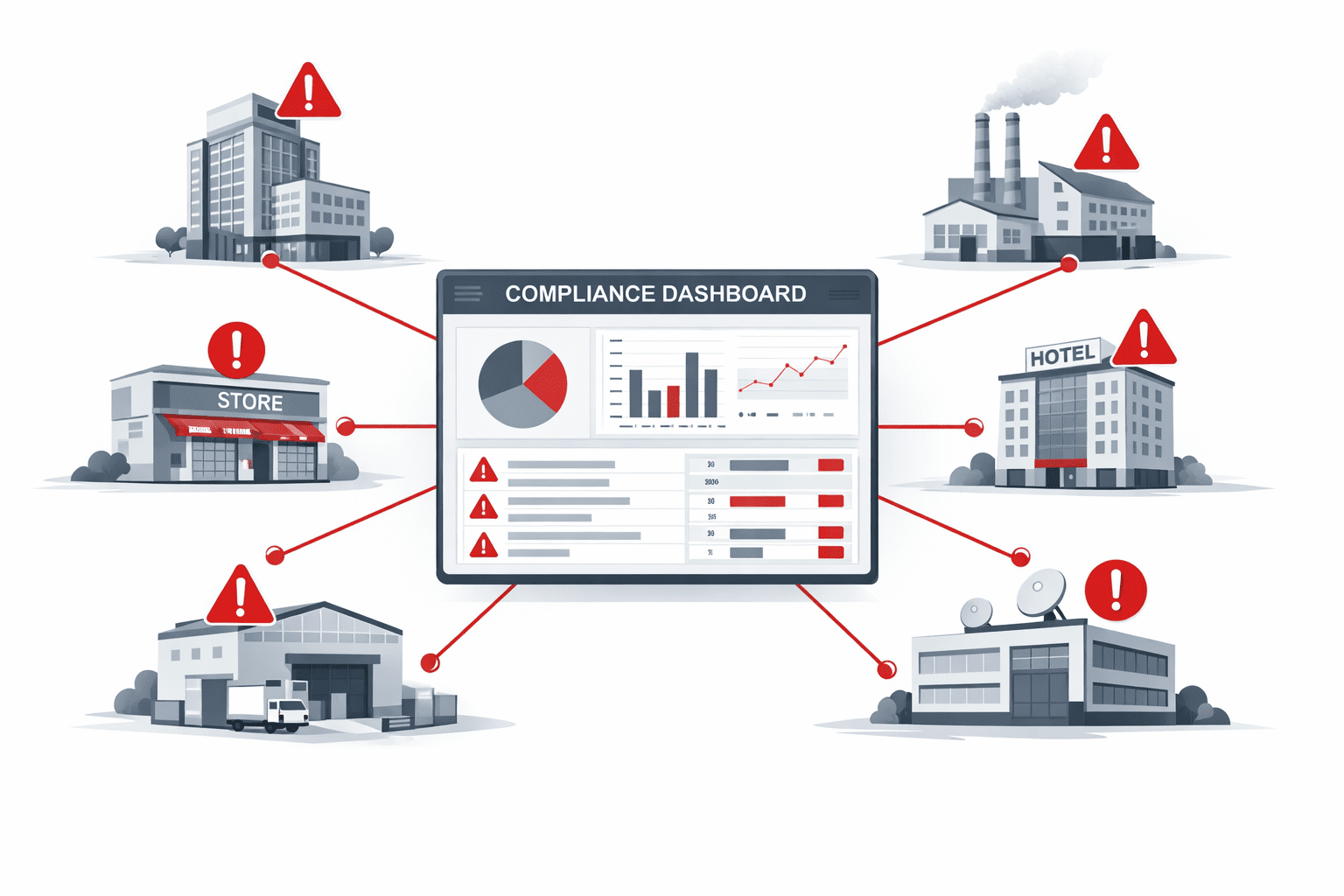

In portfolios with multiple buildings, these issues multiply quickly. What starts as one error can spread across assets.

How Energy Benchmarking Errors Happen

Most benchmarking errors are not intentional. They happen because the process is fragmented and manual.

Owners often rely on multiple teams, vendors, or spreadsheets to gather data. Utility accounts change. Meters get added or removed. Assumptions carry over from prior years.

Over time, these small issues turn into benchmarking data issues that compromise reporting accuracy.

Platforms like ENERGY STAR Portfolio Manager are powerful, but they are unforgiving. Even small setup errors can lead to incorrect results.

Common Energy Benchmarking Mistakes Building Owners Make

Many owners assume benchmarking errors are rare. In practice, they are common, especially in larger portfolios.

Below are some of the most frequent issues that lead to inaccurate energy reporting:

- Incorrect building use types or square footage entered in Portfolio Manager

- Missing or duplicate meters that skew total energy use

- Utility data gaps caused by account changes or billing delays

- Wrong reporting year selected during submission

- Data carried forward without verifying current conditions

Each of these mistakes can seem minor on its own. Together, they create significant portfolio benchmarking risk.

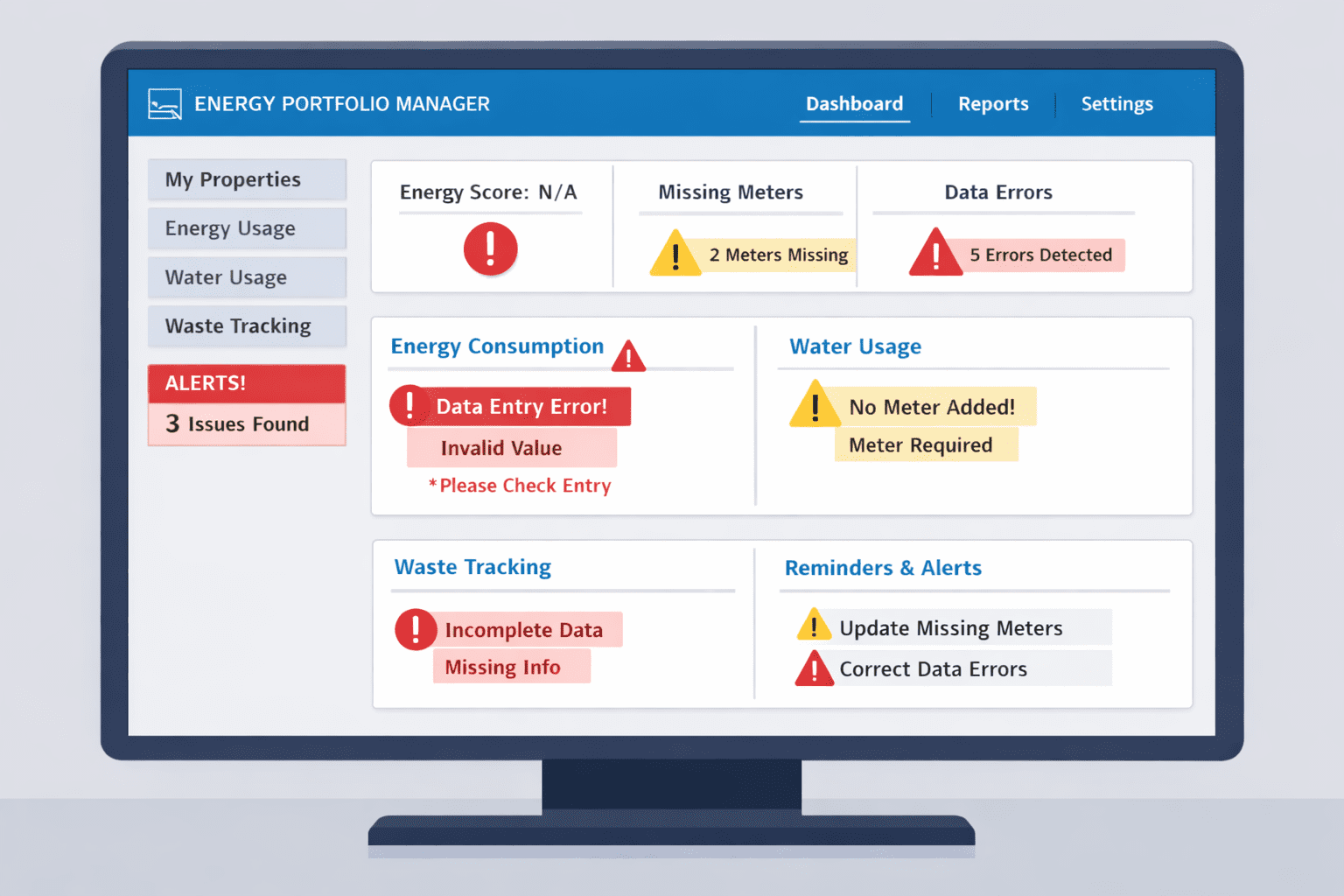

ENERGY STAR Portfolio Manager Errors Are Often Invisible

One of the biggest challenges with benchmarking is that errors are not always obvious. Portfolio Manager does not flag every issue.

A building can appear “complete” while still being inaccurate. Scores may look reasonable even when inputs are wrong.

This is why ENERGY STAR Portfolio Manager errors are so dangerous. Owners assume compliance when risk is still present.

Cities and states, however, review data differently. During audits or enforcement actions, discrepancies surface quickly.

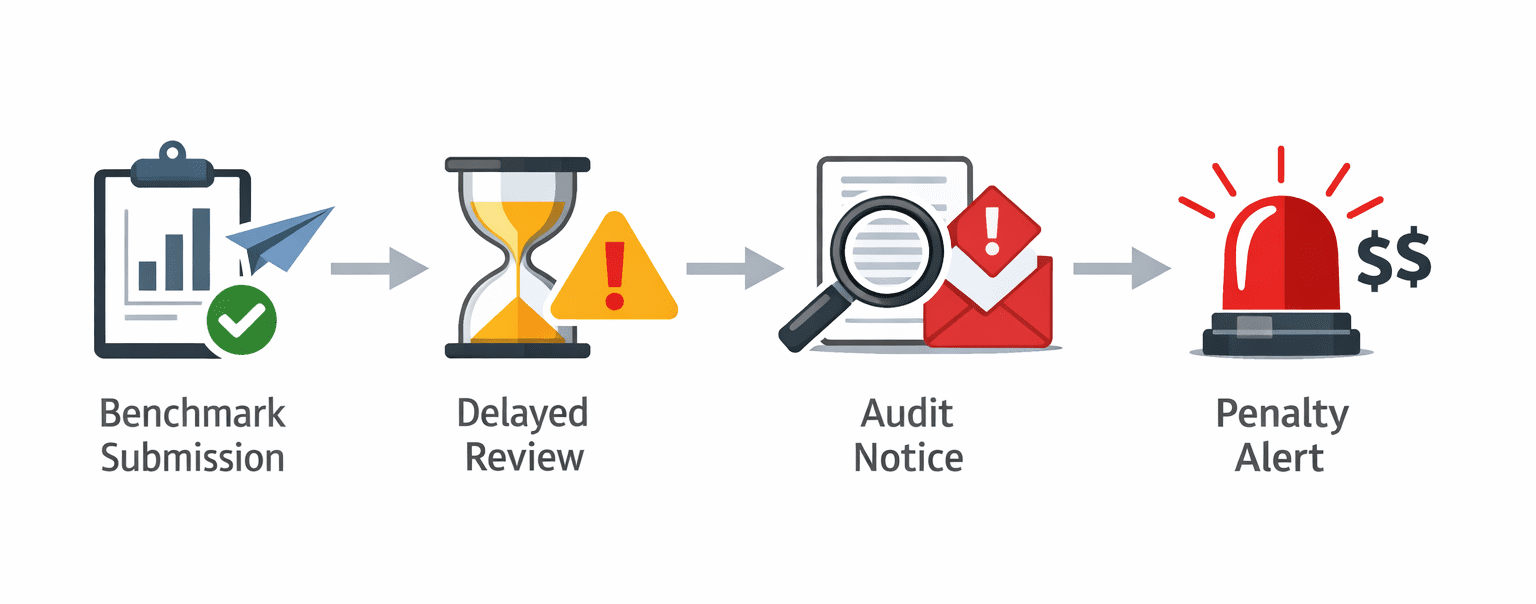

How Benchmarking Errors Lead To Compliance Penalties

Many owners ask how a simple data error turns into a fine. The answer lies in enforcement timelines. Most jurisdictions allow owners to self-report. If errors are discovered later, penalties often apply retroactively.

This is how benchmarking errors lead to compliance penalties play out in practice. A report filed on time can still be deemed noncompliant months later. Corrections may require resubmission, re-verification, or even third-party audits. All of this costs time and money.

In some cases, penalties apply per building, not per portfolio. This magnifies risk for large owners.

Portfolio Risk From Inaccurate Benchmarking

Benchmarking errors are especially risky for portfolios. One bad process repeated across assets creates systemic exposure.

If the same assumptions, templates, or vendors are used everywhere, the same mistakes show up everywhere. This creates portfolio risk from inaccurate benchmarking. A single review by a regulator can uncover issues across dozens of buildings.

At that point, fixing errors becomes reactive. Deadlines are tight. Costs increase. Trust with regulators is strained.

This is why proactive review matters more than speed.

Why Benchmarking Should Be Reviewed, Not Just Filed

Many owners focus on submitting reports on time. Fewer focus on reviewing them for accuracy.

Benchmarking data should be checked the same way financial data is checked. Inputs, assumptions, and totals should be validated. Without review, errors go unnoticed. With review, they are easy to fix.

This is where professional compliance package review services create value. They catch issues before they become penalties.

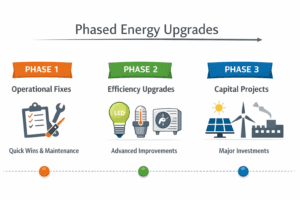

How To Fix Benchmarking Compliance Issues

Fixing benchmarking issues starts with process, not software. Owners need a clear method for validating data before submission.

Below are practical steps that reduce risk and improve accuracy:

- Verify building details like size, use type, and occupancy annually

- Reconcile utility meters against actual accounts each reporting cycle

- Review year-over-year energy changes for outliers

- Confirm submission settings before final filing

- Document assumptions and changes for future reference

These steps address how to fix benchmarking compliance issues at the root level. They also make future reporting faster and safer.

Why One-Time Fixes Are Not Enough

Some owners only address benchmarking problems after receiving a notice. That approach solves the immediate issue but leaves the system broken. Benchmarking is annual. Errors return if processes do not change.

This is why risk-focused compliance strategies matter. They focus on prevention, not reaction. A consistent review framework reduces stress, cost, and uncertainty year after year.

The Role Of A Benchmarking Checklist

Checklists are powerful because they standardize quality. They make sure nothing is missed, even when teams change.

A benchmarking checklist helps owners catch errors before submission. It also creates a record that shows good-faith compliance. This is especially useful during audits or enforcement reviews.

For portfolio owners, a checklist ensures consistency across buildings and jurisdictions.

How This Supports Compliance Package Reviews

A compliance package review brings all reporting elements together. Benchmarking, audits, and filings are evaluated as a system.

This approach identifies risks that standalone reviews miss. It also prioritizes fixes based on impact and deadlines. For owners managing multiple assets, this saves time and reduces exposure. It also turns compliance into a controlled process instead of a recurring fire drill.

Final Thoughts

Energy benchmarking errors are common, but they are also preventable. With the right process, owners can avoid penalties and protect their portfolios.

If you manage multiple buildings or jurisdictions, reviewing your benchmarking data is one of the highest-impact actions you can take.

To help, we’ve created a practical checklist that walks through the most common risks and review steps. It’s designed to help owners catch issues early and stay compliant with confidence.