Why Portfolio Risk Assessment Matters In 2026

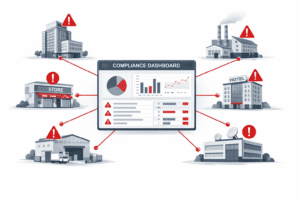

If you manage a portfolio of buildings across multiple cities or states, 2026 is shaping up to be a pivotal year for energy compliance. From mandatory energy audits to benchmarking filings and performance-based targets, dozens of major jurisdictions are enforcing stricter rules, and many of them converge in Q1 and Q2.

Without proper tracking and planning, building owners are at serious risk of missing deadlines, facing fines, or losing access to local incentives. That’s where portfolio energy compliance risk assessments come in.

These assessments provide visibility across your buildings, highlight deadline clusters, and help you proactively schedule compliance actions where they matter most.

The Compliance Landscape: Multiple Cities, One Problem

Cities like New York, Los Angeles, San Jose, Chicago, and Washington, D.C. are enforcing new performance standards, audit mandates, and benchmarking requirements. Many of these rules affect buildings over 20,000 sq. ft., especially those in the commercial, multifamily, or institutional sectors.

What makes 2026 particularly challenging is the clustering of deadlines:

Q1 2026: Benchmarking filings in several cities

Q2 2026: Energy audit completions, performance plan submissions

Rolling deadlines: Based on building size or occupancy use

If you’re managing dozens, or even hundreds, of buildings, you need to map out your deadlines now to avoid operational bottlenecks, price hikes from last-minute vendors, or even noncompliance penalties.

How Deadline Clusters Put Portfolios At Risk

A single missed deadline might result in a few thousand dollars in fines. But across 10, 20, or 100 properties? The costs skyrocket.

Even Worse, Failure To Comply Can:

- Disqualify your buildings from early adopter incentive programs

- Delay lease renewals with tenants who require ESG documentation

- Raise red flags with insurance providers and lenders

These risks are amplified when deadlines stack close together. You’re not only competing for limited contractor availability, you’re also compressing your team’s capacity to respond in time.

Real-World Example: What One Owner Faced

A national property owner managing 30 buildings across five cities conducted a compliance scan and discovered that 12 of their properties had overlapping audit deadlines within a 45-day window in Q2 2026.

Without intervention, they would have had to complete 12 energy audits, across three different vendors, while managing tenant access and coordinating internal approvals.

By Acting Early, They:

- Prioritized buildings with the earliest deadlines

- Streamlined vendor procurement with bundled RFPs

- Saved over $30,000 by avoiding peak-season pricing

- Locked in early compliance rebates in NYC and LA

What A Portfolio Risk Assessment Includes

A Property-By-Property Deadline Map:

Know exactly which buildings are due for benchmarking, audits, or reporting in 2026.

Compliance Priority Scores:

See which properties are most at risk due to timing, missing data, or local enforcement activity.

Budget Forecasts & Scheduling Recommendations:

Plan labor, vendor engagement, and capital improvements with clarity—months in advance.

Energy Compliance Deadlines For 2026

Based on publicly available enforcement calendars and legislative updates, here’s where portfolio owners should pay close attention:

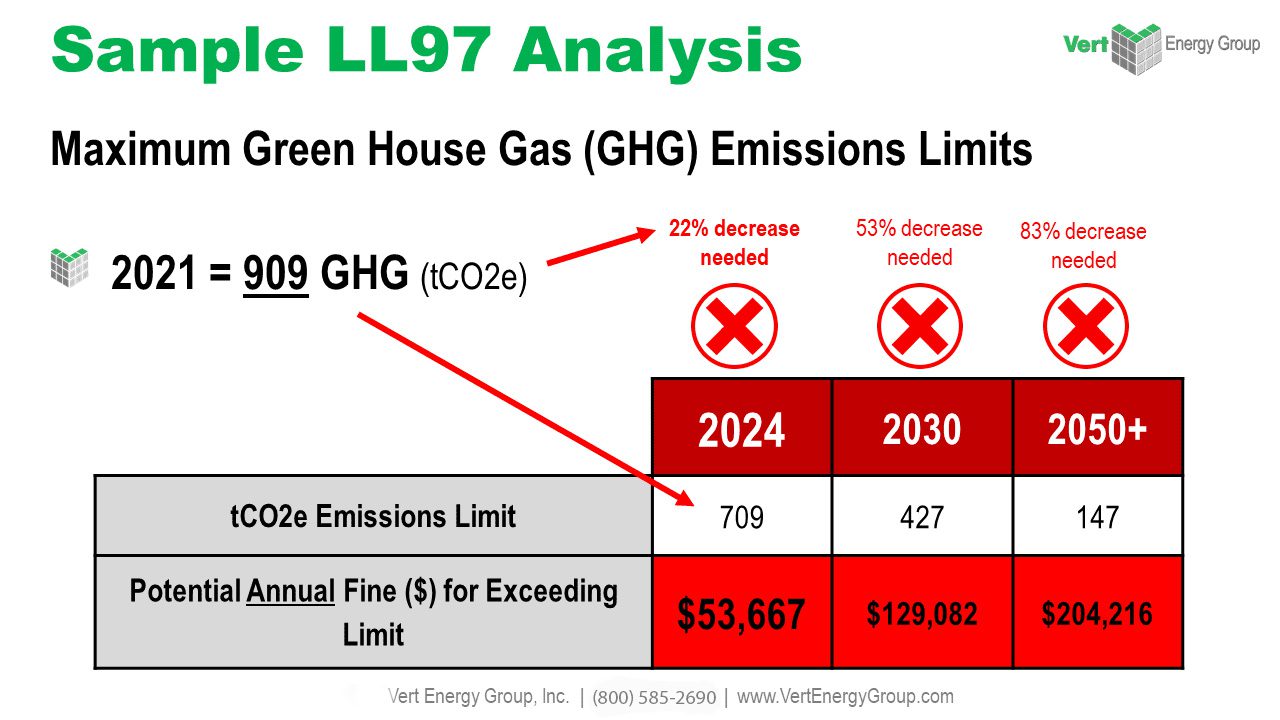

🗽 New York City (LL87 / LL97)

2026 energy audit & RCx filings for buildings >50,000 sq. ft.

Emissions penalties begin ramping up for underperformers

🌴 Los Angeles (EBEWE Phase 2)

Mandatory audits and retrofits for properties >20,000 sq. ft.

Audits due every 5 years from the property’s original compliance year

📍 San Jose & SF Bay Area

Performance-based standards rolling out in 2026

Large multifamily and commercial buildings hit Q2 deadlines

🏛️ Washington, D.C. & Washington State (BEPS & CBPS)

CBPS Tier 2 deadlines + early adopter funding milestones

BEPS 2nd cycle compliance plan deadlines begin in 2026

📉 Chicago & Midwest Cities

Benchmarking expansions and emissions tracking for >50K sq. ft. properties

Many deadlines fall in Q1/Q2 2026

Knowing this helps you prioritize the right properties first.

Tools To Help You Track And Plan

Managing compliance across 10+ buildings? You don’t need to do it manually.

The best teams rely on portfolio compliance tools to centralize and automate tracking. Look for platforms that offer:

Deadline clustering alerts

- Jurisdiction-specific rule mapping

- Audit and benchmark status tracking

- Risk scoring and progress dashboards

You can also request a Portfolio Compliance Risk Report from our team to get started fast.

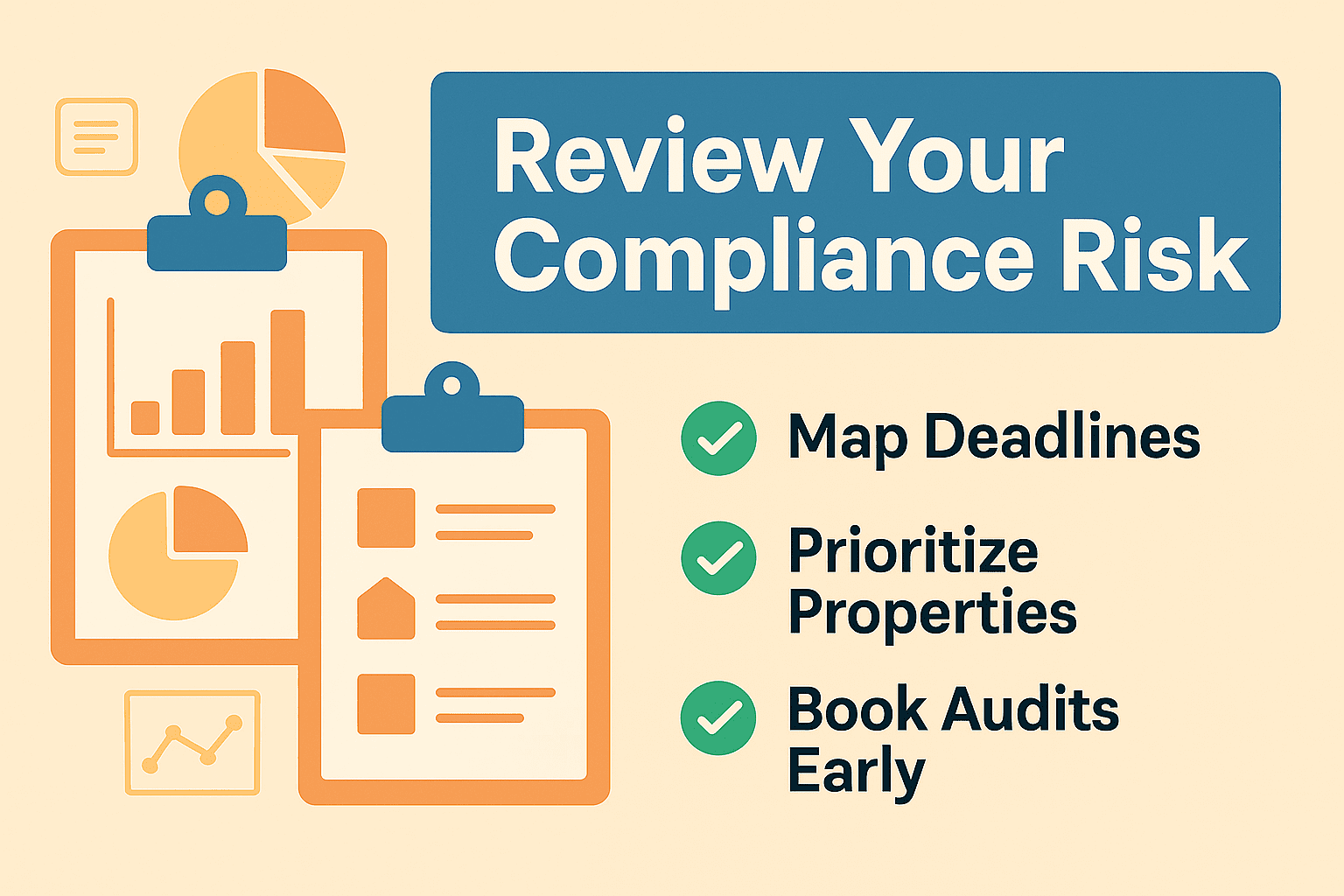

Final Thoughts: Make 2026 Your Compliance Advantage

While 2026 will be a challenging year for multi-property compliance, it’s also an opportunity to take control.

- Book your audits during low-demand windows

- Lock in utility or state incentive programs early

- Create a clean, professional audit trail for ESG reporting

Waiting only increases your costs, your risk, and your stress.

Next Steps

If you own or manage multiple buildings, now is the time to scan your portfolio and identify the 2026 clusters that could disrupt your operations.