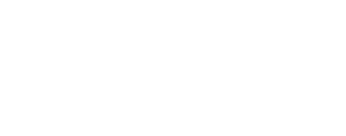

If you own or manage multiple commercial properties, energy compliance in 2026 won’t just be about one deadline, it’ll be about many.

Different cities, different ordinances, and different due dates can make energy audits across your portfolio feel like a full-time job. But there’s a better way to handle it: schedule a Q1 portfolio energy audit strategy that covers everything in one coordinated plan.

By acting early, you avoid the mid-year crunch, reduce costs, and stay compliant across every city, without chasing updates, managing vendors, or missing filings.

Why Portfolio Owners Need A Q1 Audit Strategy

Energy laws are no longer limited to a few major cities. Across the U.S., more local governments are requiring energy audits for commercial buildings, often tied to performance scores, benchmarking results, or building size.

If you manage five, ten, or even fifty properties across different regions, each one might have:

- A unique audit cycle

- Different city-level submission portals

- Separate penalties for missed or late filings

- Changing requirements from one year to the next

Trying to manage all of that manually is risky. Q1 is the best time to map it out and lock in support before demand surges later in the year.

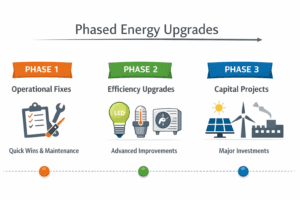

What Happens Without A Portfolio Audit Plan?

Without a multi-building audit strategy, deadlines start to overlap, vendors book up, and compliance tasks pile up fast. Building owners often don’t realize they’ve missed a requirement until they receive a fine, or get listed as non-compliant in a public registry.

Even worse, scattered audit timelines make it harder to manage budgets. If you’re scheduling building after building on separate timelines, you may be paying higher per-property rates, rush fees, or scrambling for help when deadlines hit all at once.

A centralized, early plan gives you control. You can group sites by location, assign audit vendors in batches, and build a schedule that avoids unnecessary costs and surprises.

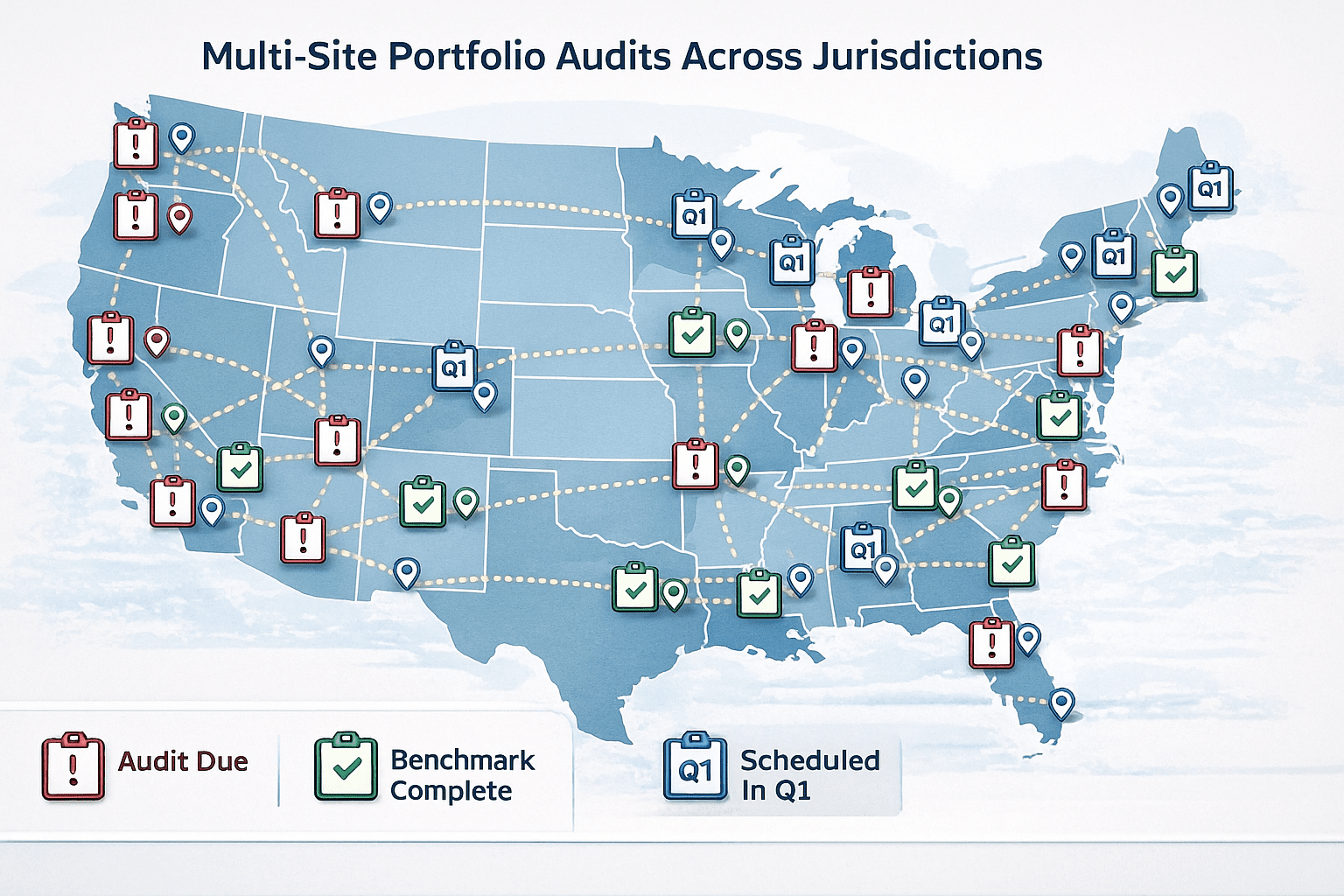

Benefits Of A Portfolio-Wide Energy Audit Strategy

Coordinating energy audits across your portfolio brings both short-term and long-term value. It simplifies compliance now, and sets your team up for smoother filings in future years.

Key benefits include:

- Time savings – Manage dozens of properties through one process instead of repeating steps city by city.

- Lower cost per audit – Many firms offer better pricing for bundled or regional services.

- Less risk of non-compliance – Stay ahead of city-by-city audit deadlines without the guesswork.

- Better reporting – Consistent audit data across buildings supports benchmarking, investment planning, and ESG tracking.

- Less stress in Q3/Q4 – When others are scrambling to meet deadlines, your audits will already be done.

Common Challenges In Multi-Property Compliance

If you’ve tried to manage commercial portfolio compliance without a centralized system, you know how difficult it can be. Every jurisdiction may have its own set of forms, formats, and file requirements.

Some cities require ENERGY STAR Portfolio Manager integration, while others want direct portal uploads. In one city, your audit may be due every five years; in another, it’s triggered by low benchmarking performance or EUI scores.

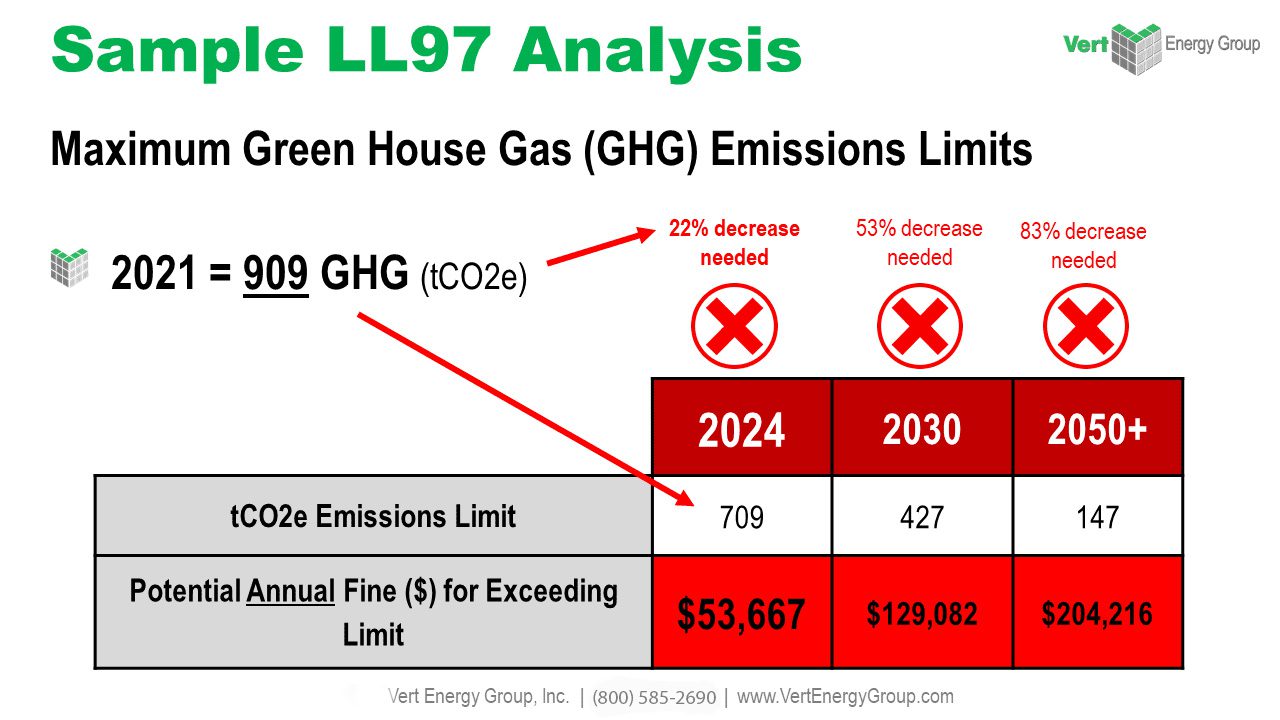

And because cities often update these rules without much notice, owners who wait until mid-year to begin audits are often left scrambling, or worse, paying penalties.

How To Coordinate Audits Across Multiple Properties

The smart way to manage 2026 multi-property audits is to create a portfolio-wide Q1 audit plan. This doesn’t mean you need every audit completed by March—but it does mean getting a full view of what’s due, by when, and where.

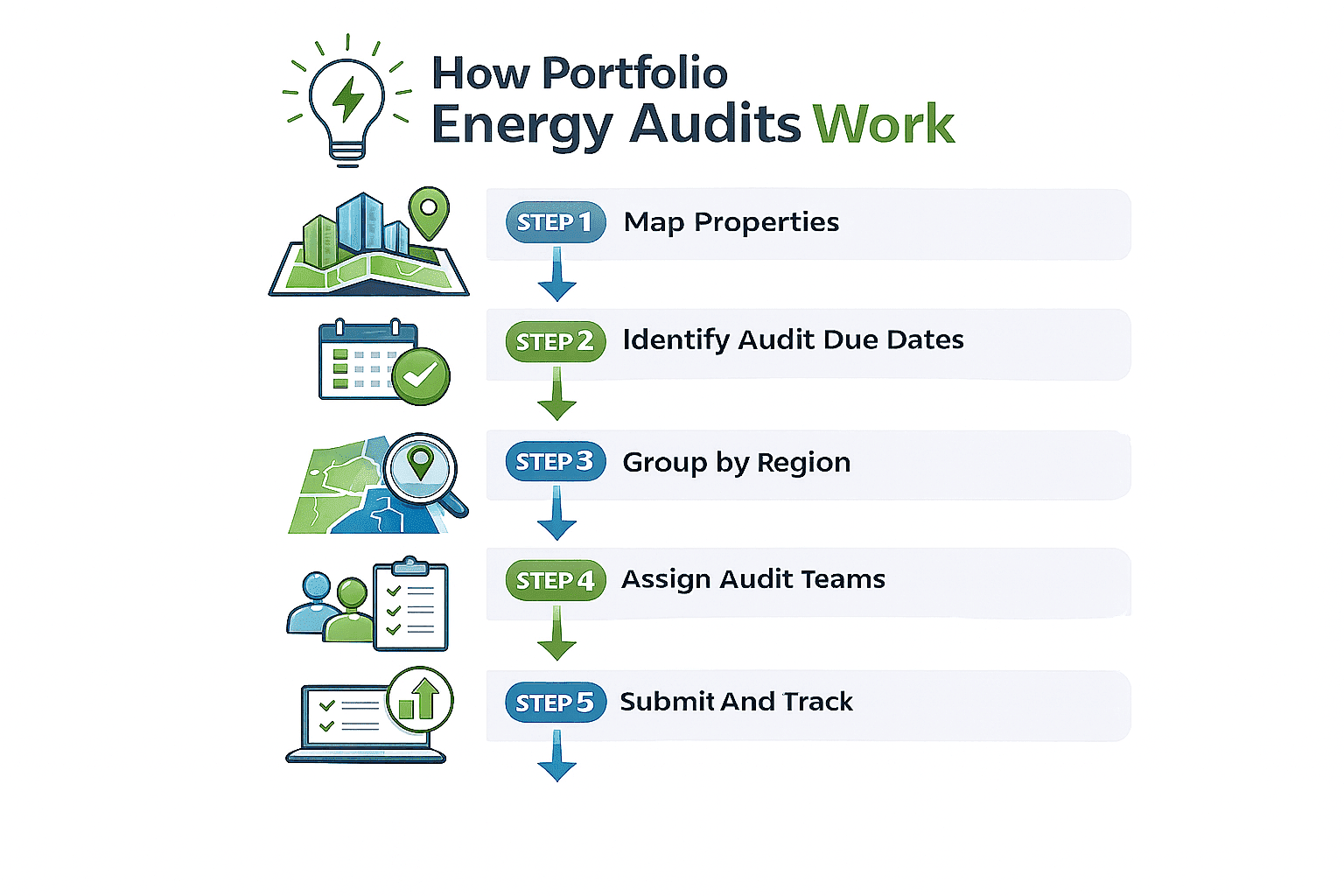

Here’s how we help portfolio owners prepare:

- We map all your properties against their city or state audit requirements.

- We identify which buildings are due in 2026, and which ones can be bundled by location.

- We assign qualified local audit teams to your buildings across regions.

- We track deadlines and submissions across cities so you don’t have to.

- We give you a single dashboard or summary report for your internal team, investors, or compliance officers.

By setting this up in Q1, you avoid the late-year crunch and unlock better pricing and scheduling flexibility.

Who Should Use A Portfolio Audit Service?

Any owner, manager, or asset team overseeing more than one commercial property should consider a portfolio audit service, especially if those buildings are in different jurisdictions.

This includes:

- Commercial real estate firms

- REITs and investment groups

- Multi-site tenants

- Property management companies

- National building owners with state-level compliance exposure

The more buildings you own, the more value you gain from centralizing your audits.

Final Thought: Q1 Is Your Window To Simplify 2026

If you wait until Q2 or Q3 to start your energy audits, you’ll be fighting for vendor time, paying rush fees, and juggling too many deadlines at once. But if you start in Q1, you can:

- Get organized

- Cut costs

- Prevent compliance risks

- Free up your team for higher-value work

With a smart Q1 audit planning strategy, your entire portfolio can move through 2026 smoothly, with fewer delays, fewer fines, and better reporting.