It is 2026 and portfolio managers are facing new deadlines, more laws, and greater risk than ever before. The difference between staying compliant and getting penalized now comes down to one thing: visibility.

This is where 360 energy compliance changes the game.

Instead of tracking benchmarking, audits, and Building Performance Standards (BPS) in silos or separate teams, 360 Compliance brings everything into one coordinated strategy. The result is clarity, control, and confidence across your entire portfolio.

Energy Compliance Has Outgrown Spreadsheets

What worked for compliance last year no longer works today. Most portfolios still manage energy compliance with spreadsheets, calendar reminders, and vendor emails. That approach breaks down as soon as buildings span multiple cities or states.

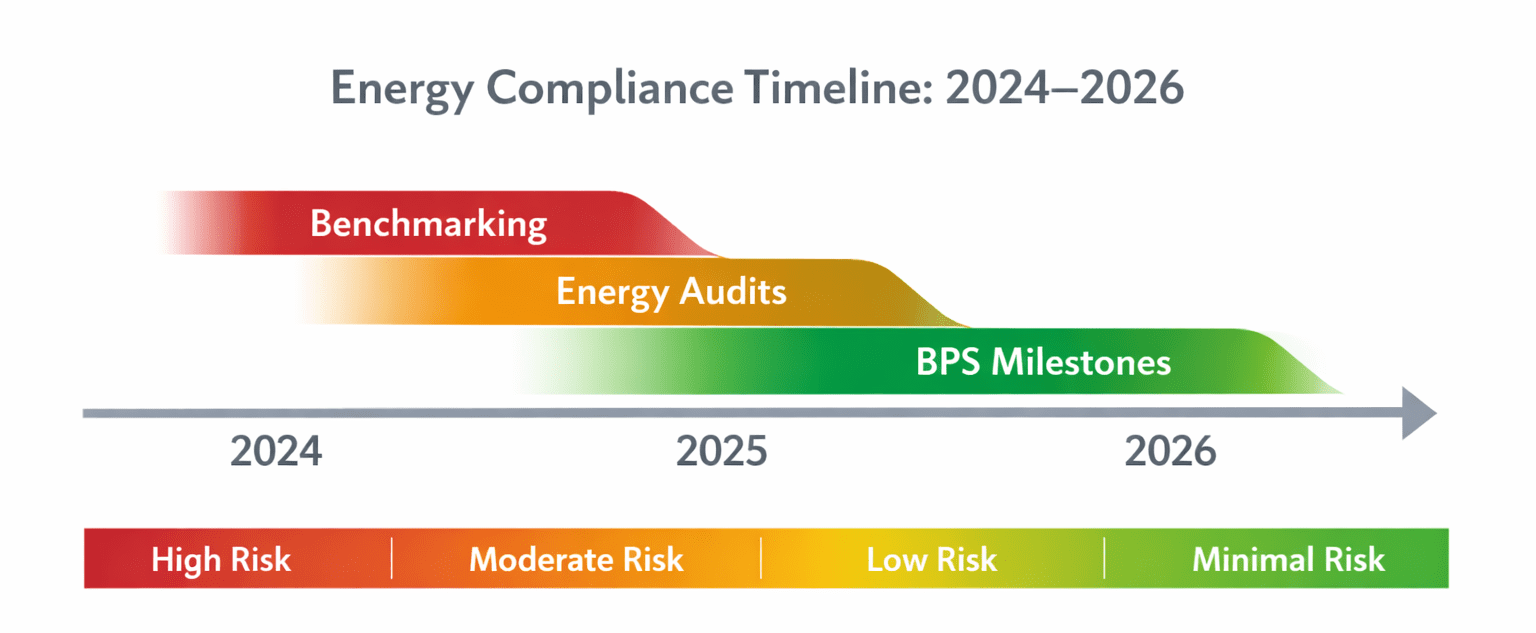

Energy laws now change annually, vary by jurisdiction, and overlap in ways that are hard to track manually. Benchmarking deadlines can trigger audit requirements, which then roll into BPS performance targets. Without a centralized system, it’s easy to miss how one requirement affects another.

This growing complexity is why portfolio energy compliance can no longer be handled building by building. It needs 360 management.

2026 Is A Tipping Point For Building Energy Laws

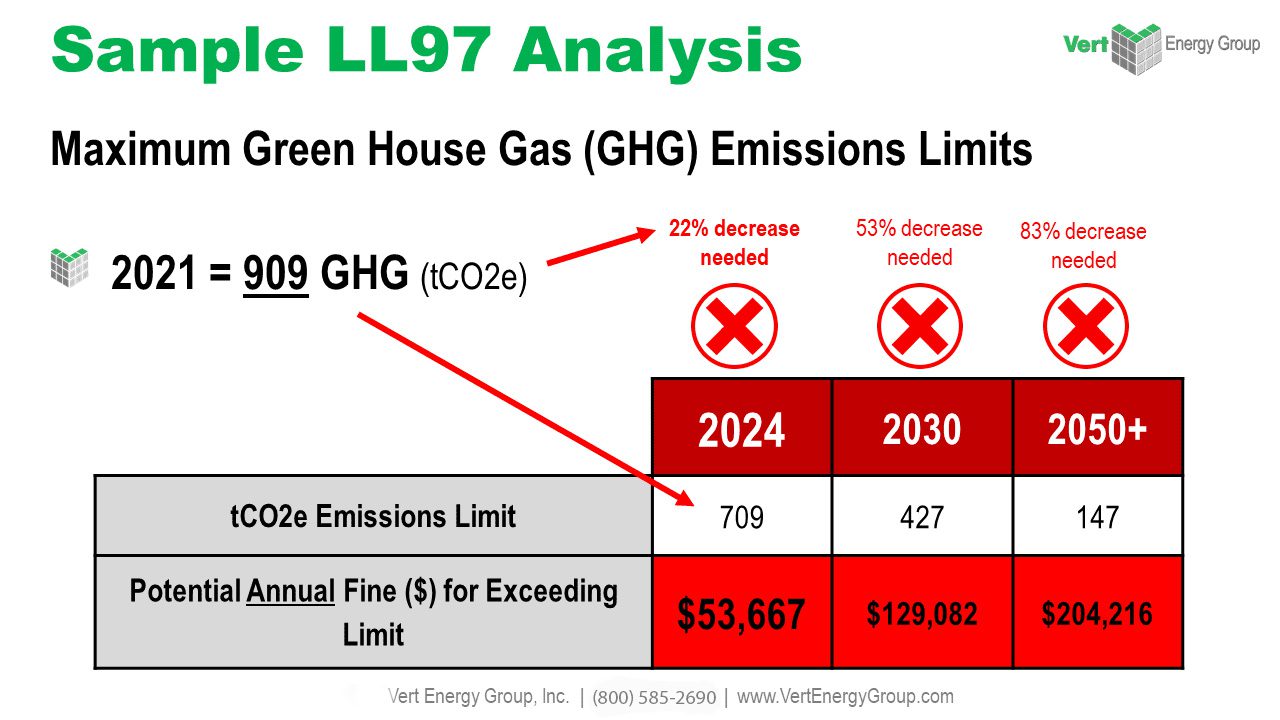

The year 2026 marks a shift from reporting to performance. Many cities are moving beyond basic benchmarking and requiring proof of improvement. That includes emissions caps, Energy Use Intensity (EUI) targets, and corrective action plans tied to penalties.

For portfolio owners, this creates a clustering effect. Multiple buildings may face different deadlines in the same year, even within the same city. Without portfolio-level visibility, risk compounds quickly.

2026 is not just another compliance year. It is the moment when energy compliance tracking becomes a business-critical function.

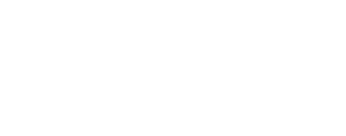

Visibility Is The Missing Link In Compliance Management

Most compliance failures are not caused by inaction. They are caused by blind spots. Owners often believe a building is compliant because one task was completed, while another requirement was triggered without notice.

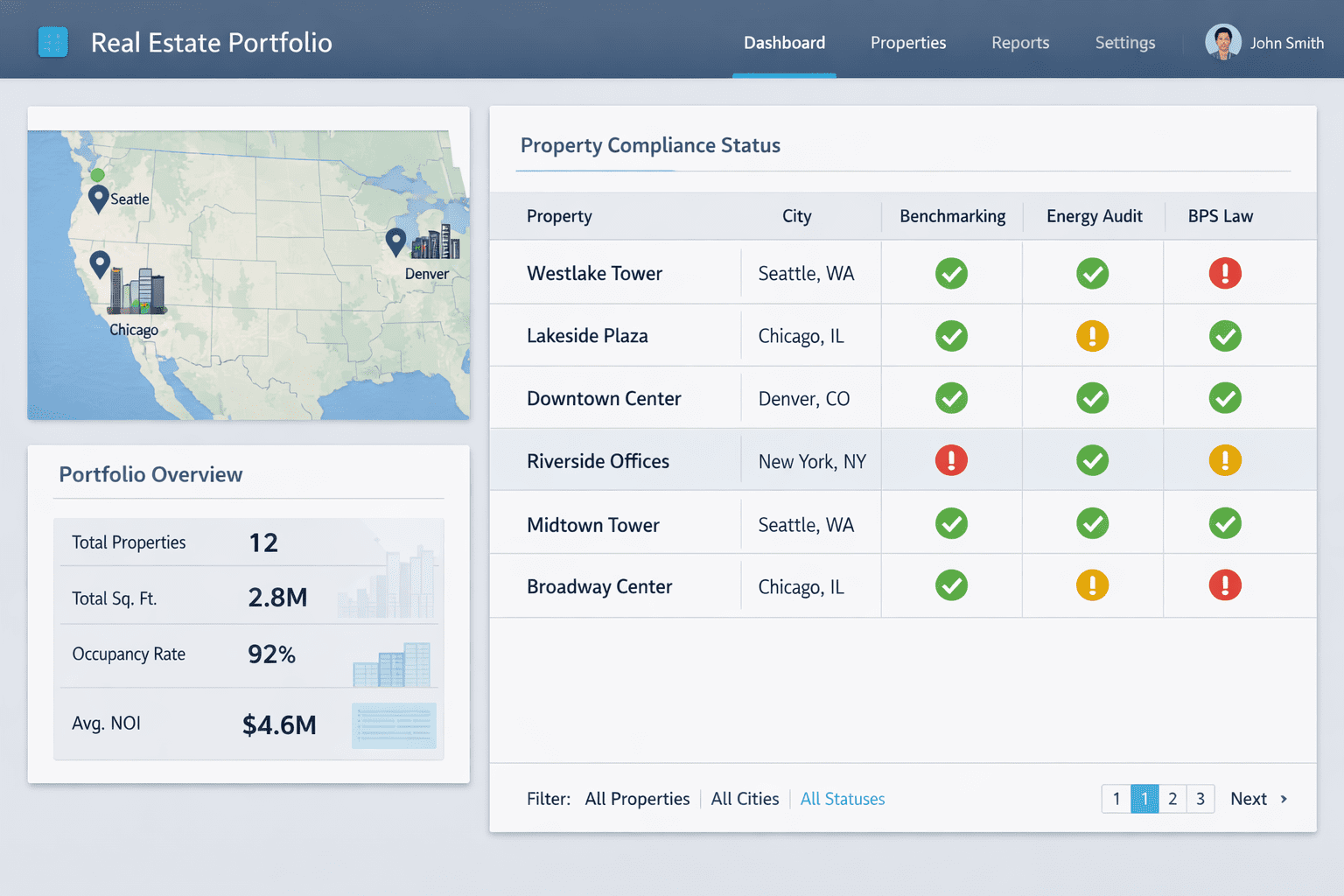

True visibility means knowing, at any moment, which buildings are compliant, which are at risk, and which actions are coming next. It also means understanding how today’s decisions affect future deadlines and costs.

Building energy compliance management requires a system that shows the full picture, not just individual tasks.

What 360 Energy Compliance Actually Means

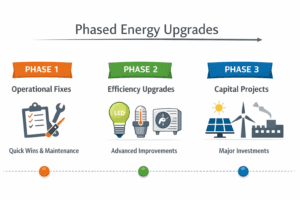

360 Compliance is a portfolio-wide approach to managing energy laws across all buildings and jurisdictions. It connects benchmarking, audits, and BPS into a single operational view.

Instead of reacting to deadlines, you operate from a live compliance roadmap. Every requirement is tracked, scheduled, and aligned with future performance goals. This removes uncertainty and replaces it with structure.

At its core, 360 energy compliance is about replacing fragmented workflows with one source of truth.

How 360 Compliance Works Across A Portfolio

A 360 Compliance model starts by mapping every building against applicable local, state, and federal energy laws. From there, it creates a timeline that shows how requirements overlap and trigger one another.

Key components typically include:

- Portfolio-wide benchmarking and reporting coordination

- Audit scheduling aligned with future BPS requirements

- Performance tracking tied to EUI or emissions targets

- Ongoing monitoring of law changes and enforcement updates

This approach transforms compliance from a reactive task into a proactive strategy.

The Risk Of Managing Compliance Building By Building

Managing each property in isolation increases both cost and exposure. Vendors are hired multiple times, deadlines are duplicated, and knowledge is lost between cycles.

More importantly, siloed management makes it impossible to see portfolio-level risk. One missed audit or late filing can trigger fines that ripple across ownership entities, lenders, or investors.

A portfolio compliance strategy eliminates these inefficiencies by treating compliance as a continuous system, not a series of one-off events.

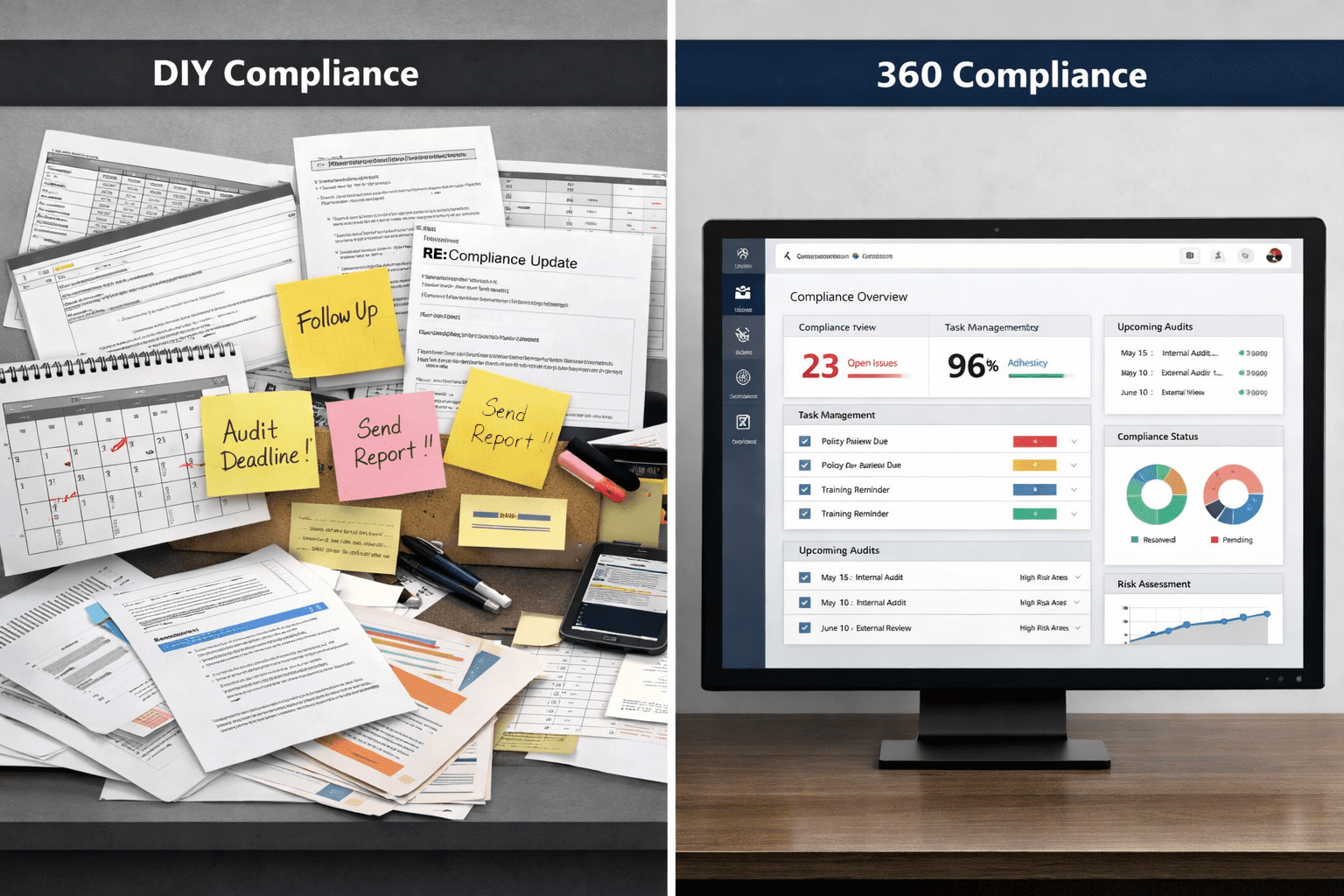

DIY Compliance VS. 360 Compliance

Many owners attempt to manage compliance internally, believing it will save money. In reality, the hidden costs often exceed the price of a managed solution.

| Area | DIY Compliance | 360 Compliance |

| Deadline tracking | Manual, error-prone | Automated, monitored |

| Law updates | Often missed | Continuously updated |

| Vendor coordination | Fragmented | Centralized |

| Portfolio visibility | Limited | Real-time |

| Penalty risk | High | Actively mitigated |

This comparison highlights why energy law compliance services are becoming essential for portfolios of any size.

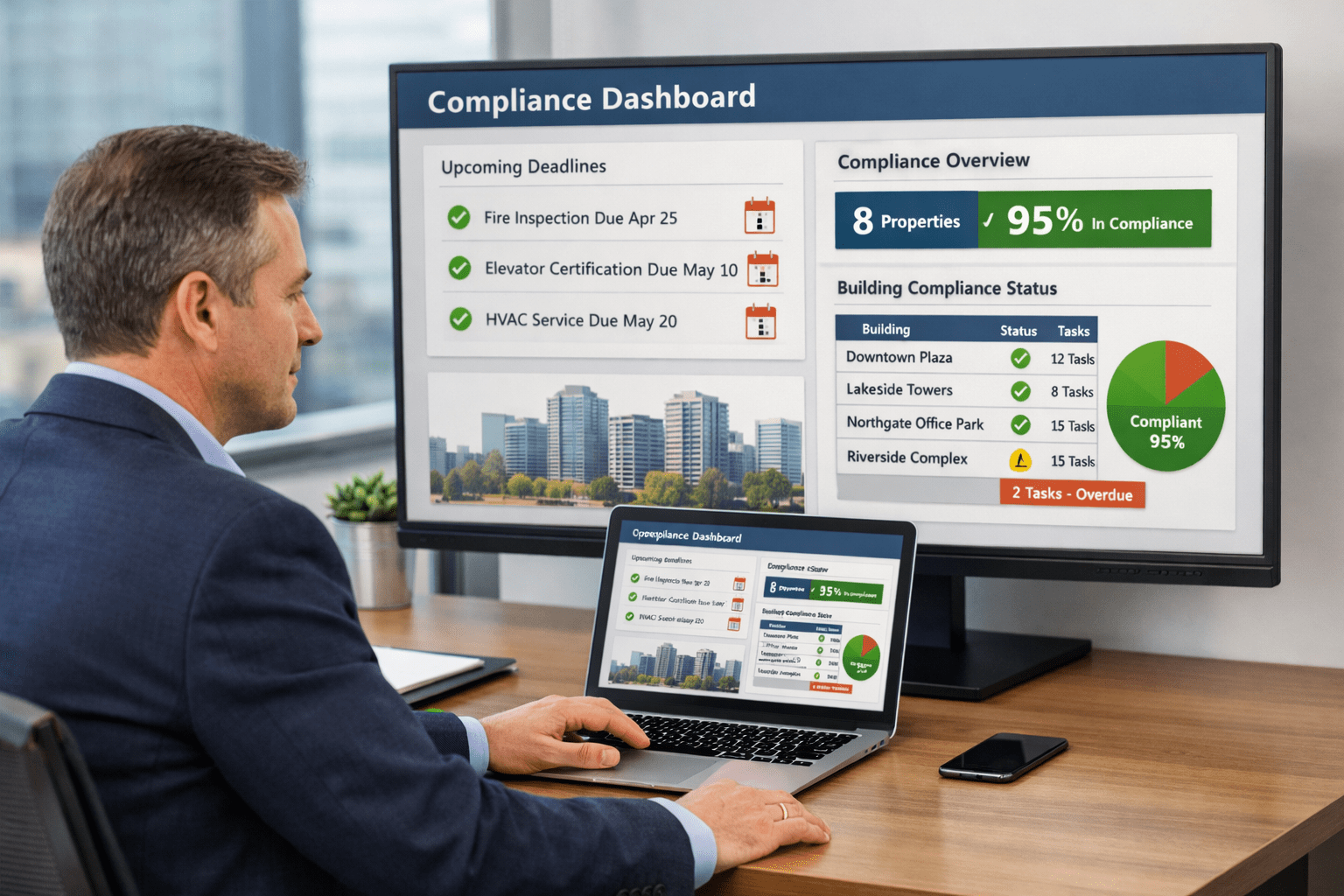

How 360 Compliance Reduces Cost And Risk

Visibility reduces surprises, and surprises are expensive. When you know what’s coming, you can schedule work earlier, secure better pricing, and avoid rush fees.

360 Compliance also allows owners to align audits and upgrades with capital planning cycles. This prevents emergency spending and supports long-term asset strategy.

Over time, this approach lowers total compliance costs while protecting NOI and asset value.

Managing Benchmarking, Audits, And BPS Together

One of the biggest advantages of 360 Compliance is integration. Benchmarking data informs audit scope. Audit findings support BPS planning. BPS requirements shape future benchmarking strategy.

When these elements are managed separately, opportunities are missed. When managed together, compliance becomes a performance tool rather than a regulatory burden.

This is the foundation of multi-building compliance done correctly.

360 Compliance Supports Smarter Decision-Making

With a complete compliance view, owners can make informed decisions about upgrades, exemptions, and alternative compliance pathways. You are no longer guessing which building needs attention first.

This level of insight is especially valuable for acquisitions, refinancing, and ESG reporting. Lenders and investors increasingly expect proof of compliance readiness across portfolios.

360 Compliance provides that proof.

Why Visibility Drives Long-Term Compliance Success

Compliance is not a one-time project. It is an ongoing obligation that evolves as laws change. Visibility ensures that each cycle builds on the last, rather than starting from scratch.

By maintaining a continuous compliance record, portfolios become more resilient to regulatory change. This is critical as enforcement accelerates nationwide.

In 2026 and beyond, visibility will separate compliant portfolios from penalized ones.

The Role Of A 360 Compliance Check

A 360 compliance check for commercial buildings is often the first step. It assesses current compliance status, identifies gaps, and maps upcoming deadlines across the portfolio.

This snapshot allows owners to prioritize actions and understand exposure before penalties begin. It also provides a baseline for ongoing management.

Without this check, portfolios are operating without a map.

Why 2026 Starts With 360 Compliance

2026 is not just about new deadlines. It is about managing complexity at scale. Portfolios that succeed will be those that invest in visibility now.

360 Compliance is not about doing more work. It is about doing the right work, at the right time, with full awareness of what comes next.

If you want to track energy compliance across multiple buildings, reduce risk, and stay ahead of evolving laws, 2026 starts with 360 Compliance.

Ready to see what full visibility looks like?

Explore VertPro’s 360 Compliance Solution and connect it with your benchmarking, audit, and BPS strategy today.