Multi-City Compliance in 2025: Comparing LA, NYC, & Seattle Energy Audit Penalties.

How you manage energy audits across multiple cities is about to change. 2025 brought strict fines in Los Angeles, New York City, and Seattle. National property owners need a clear idea they can act on, before deadlines, to prevent penalties form piling up city by city.

Why 2025 Is A Big Year For Energy Audits

Fine enforcement has made audit compliance a checkpoint with financial teeth.

In 2025, LA, NYC, and Seattle will all enforce audit mandates with escalating fines for late reporting, non-compliance, or misrepresentation. For portfolio owners, that means one missed deadline in one city can trigger six-figure penalties.

To understand the risks, let’s break down what each city requires and how the penalties compare.

Los Angeles: Energy Audits Under EBEWE

Los Angeles uses the (EBEWE) ordinance to determine your compliance.

Buildings over 20,000 square feet must submit benchmarking annually and conduct periodic energy audits and retro-commissioning.

Fines stack quickly: late submissions can trigger daily penalties, and failure to comply after multiple notices can add up to tens of thousands per property. The city’s Department of Building and Safety treats non-compliance as a code violation, which means property resale or refinancing can be impacted.

While LA fine enforcement is bad, New York City takes an even stricter stance tying non-compliance to automatic annual fines.

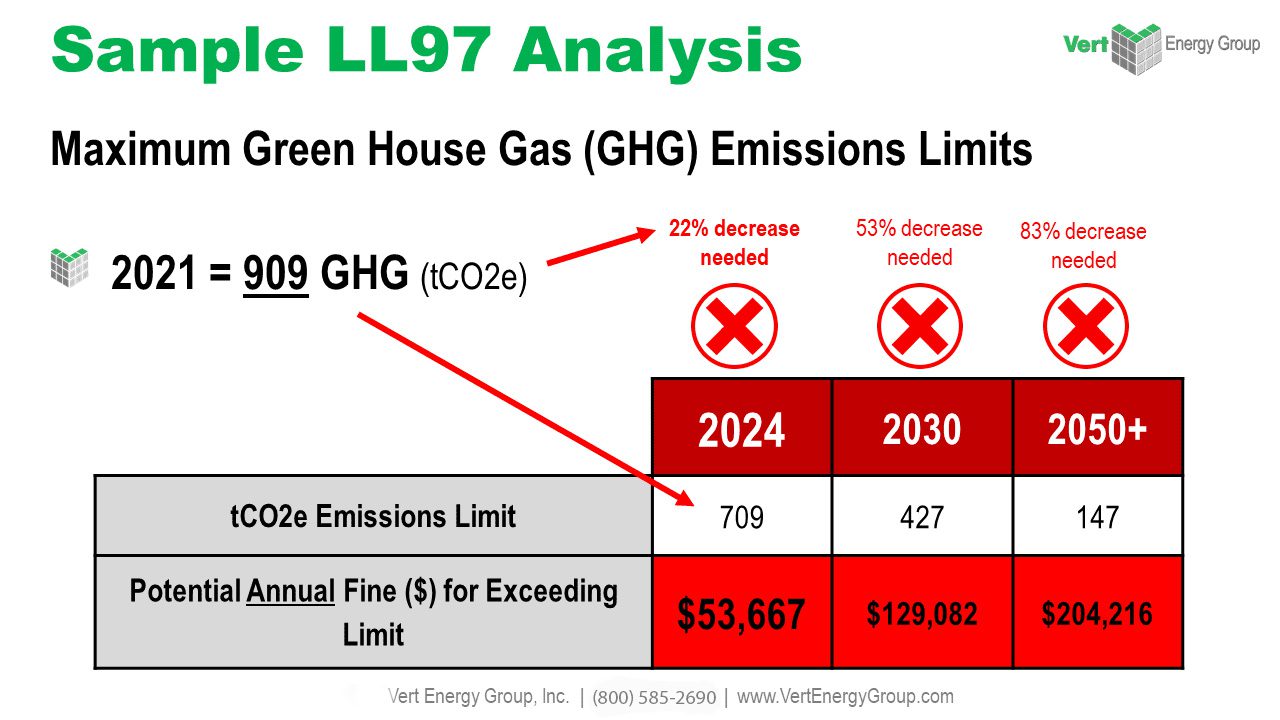

New York City: The Weight of Local Law 97

In NYC, Local Law 97 provides steep fines for exceeding emissions limits along with penalties for missed energy audits and retro-commissioning under Local Laws 84 and 87.

Owners in NYC face some of the most expensive energy penalties in the country.

Under LL97, buildings over 25,000 square feet must stay under annual carbon caps starting 2024–2025. Non-compliance results in $268 per metric ton of CO₂ equivalent over the limit. Separately, missed audits under LL87 bring fines of $3,000 for the first year and $5,000 for each additional year. These fines are assessed annually until the report is submitted.

Compared to NYC’s aggressive penalties, Seattle’s approach blends fines with escalating enforcement notices.

Seattle: OSE Energy Benchmarking and Audits

Seattle enforces energy requirements through its Office of Sustainability & Environment (OSE).

Commercial and multifamily buildings over 20,000 square feet must benchmark annually, while audits are required for certain building types and performance thresholds.

Seattle fines for non-compliance may appear smaller, but they accumulate over time.

The city imposes $500 fines for the first violation and up to $1,500 for subsequent violations. Failure to comply after repeated notices can result in enforcement actions that block permits or city approvals. While the per-building fines are lower than NYC’s, portfolio owners with multiple Seattle assets face compound risks.

With three cities each running distinct compliance regimes, the challenge is balancing compliance across multiple jurisdictions.

Side-by-Side: Comparing LA, NYC, and Seattle Audit Penalties

For multi-city property owners the only way to manage risk is to compare city rules on a single map. Here’s how the penalties stack up in 2025:

🏙️ Los Angeles (EBEWE)

-

📅 Daily fines for late audit submissions

-

⚠️ Treated as code violations

-

🏦 Impacts property sales & refinancing

🗽 New York City (LL97, LL87)

-

🌍 $268 per ton CO₂ over the emissions cap

-

📑 $3,000–$5,000 per year for missed audit reports

-

💰 Fines assessed annually until reports are filed

🌲 Seattle (OSE)

-

💵 $500–$1,500 fines, escalating with repeat violations

-

🔁 Accumulate over time with multiple properties

-

🚫 Can block permits & city approvals

The picture is clear, NYC is the costliest per property, but LA and Seattle fines multiply risk when managing portfolios with multiple assets.

With penalties clarified, the bigger question is how portfolio owners can stay ahead of compliance across cities.

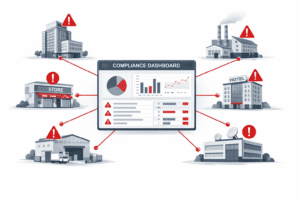

The Portfolio-Wide Compliance Challenge

Managing and self-reporting audits city by city isn’t scalable.

Property Owners with national portfolios need better and more effective compliance strategies.

Multi-jurisdiction compliance is best handled by experts. Working with an expert ensures consistent data gathering, consolidated benchmarking, and coordinated audit scheduling across jurisdictions. This avoids the chaos of handling LA, NYC, and Seattle separately, and prevents costly oversights.

So how do you take action before 2025 penalties hit? By following a structured roadmap.

Your 4-Step Roadmap to Multi-City Compliance

To stay compliant across LA, NYC, and Seattle in 2025, follow these steps:

Map your portfolio exposure: Identify which buildings trigger audit requirements in each city.

Centralize audit scheduling: Align deadlines across jurisdictions so no city falls through the cracks.

Standardize documentation: Create a unified compliance file that satisfies LA, NYC, and Seattle reporting formats.

Engage multi-city compliance experts: Compliance experts have a process to oversee audits, file reports, and mitigate penalties portfolio-wide.

This roadmap reduces complexity, lowers the risk of missed deadlines, and makes audits manageable for national property managers.

Following this roadmap prepares owners to move from reactive compliance to proactive planning.

Why National Portfolio Owners Need Comparative Consulting

National property owners juggle inconsistent city rules.

Working with compliance experts ensures you get a city-by-city audit calendar, penalty avoidance planning, and audit coordination across LA, NYC, and Seattle. This will protect your property from fines and create visibility across the entire portfolio.

At this point, the only question is whether you’ll prepare in advance or pay penalties later.

Final Thought: The Cost of Waiting

2025 signals the start of fine enforcement ramping up. Non-compliance in LA, NYC, or Seattle carries real costs, from thousands in fines to blocked permits and lost refinancing opportunities.

Portfolio-wide compliance planning isn’t optional, it’s the only way to avoid penalties, protect asset value, and stay ahead of shifting regulations.

Get Compliant Across All Cities With…. 👉 The Instant Audit Pricing Tool Now