ROI Of Energy Benchmarking: How It Pays Off Long-Term

Energy benchmarking is a proven strategy for cutting costs, improving building performance, and enhancing long-term asset value. Whether you’re managing a single commercial property or a national portfolio, understanding the return on energy investment (ROI) is essential to making smarter, future-proof building decisions.

Let’s explore how benchmarking can deliver measurable financial impact, reduce energy use, and create value that compounds over time.

What Is Energy Benchmarking ROI?

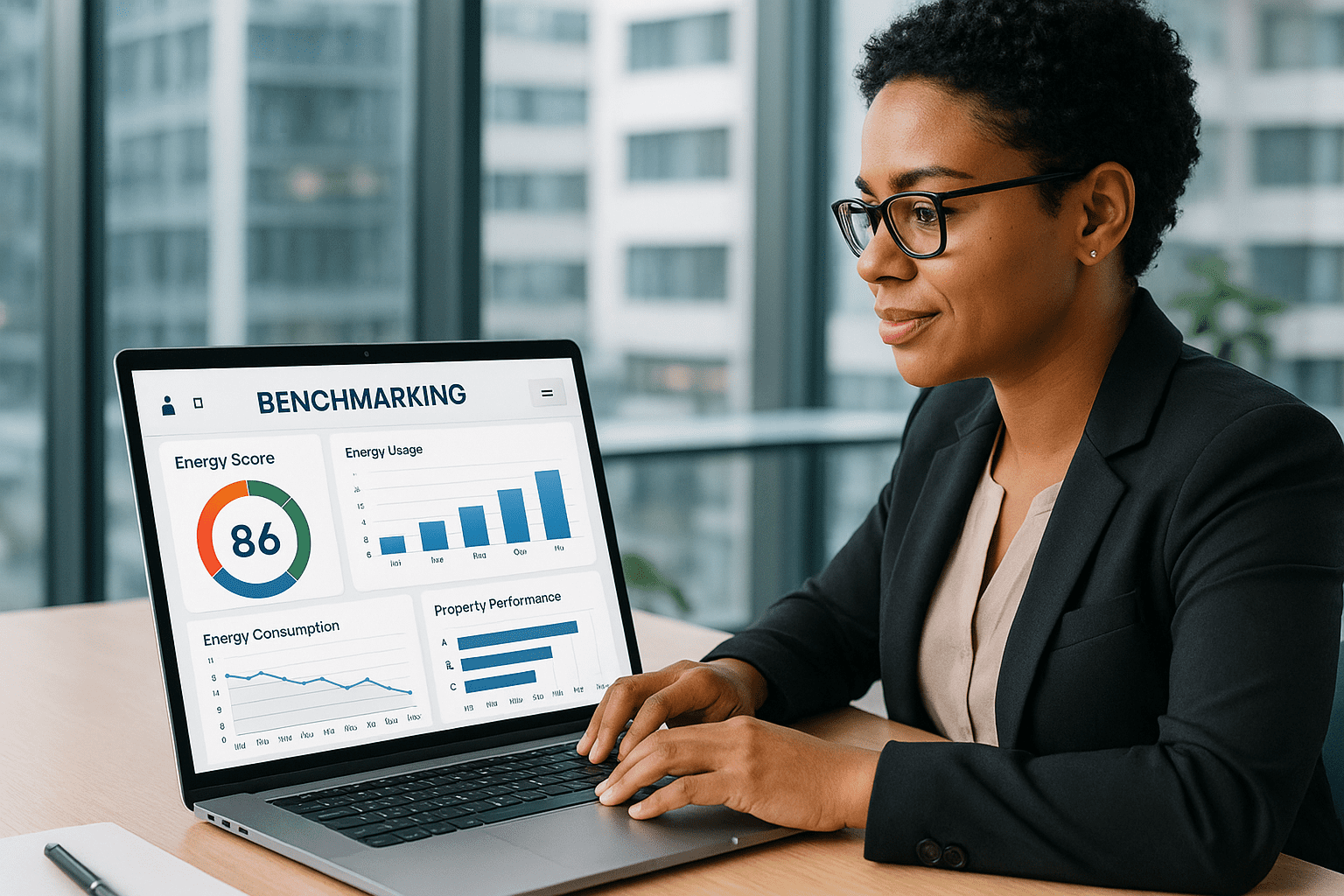

Energy benchmarking involves the regular tracking, analyzing, and reporting of a building’s energy consumption. By using platforms like ENERGY STAR Portfolio Manager, property owners and managers gain insight into how their buildings perform compared to similar assets, and identify where performance improvements can generate real savings.

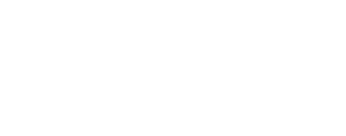

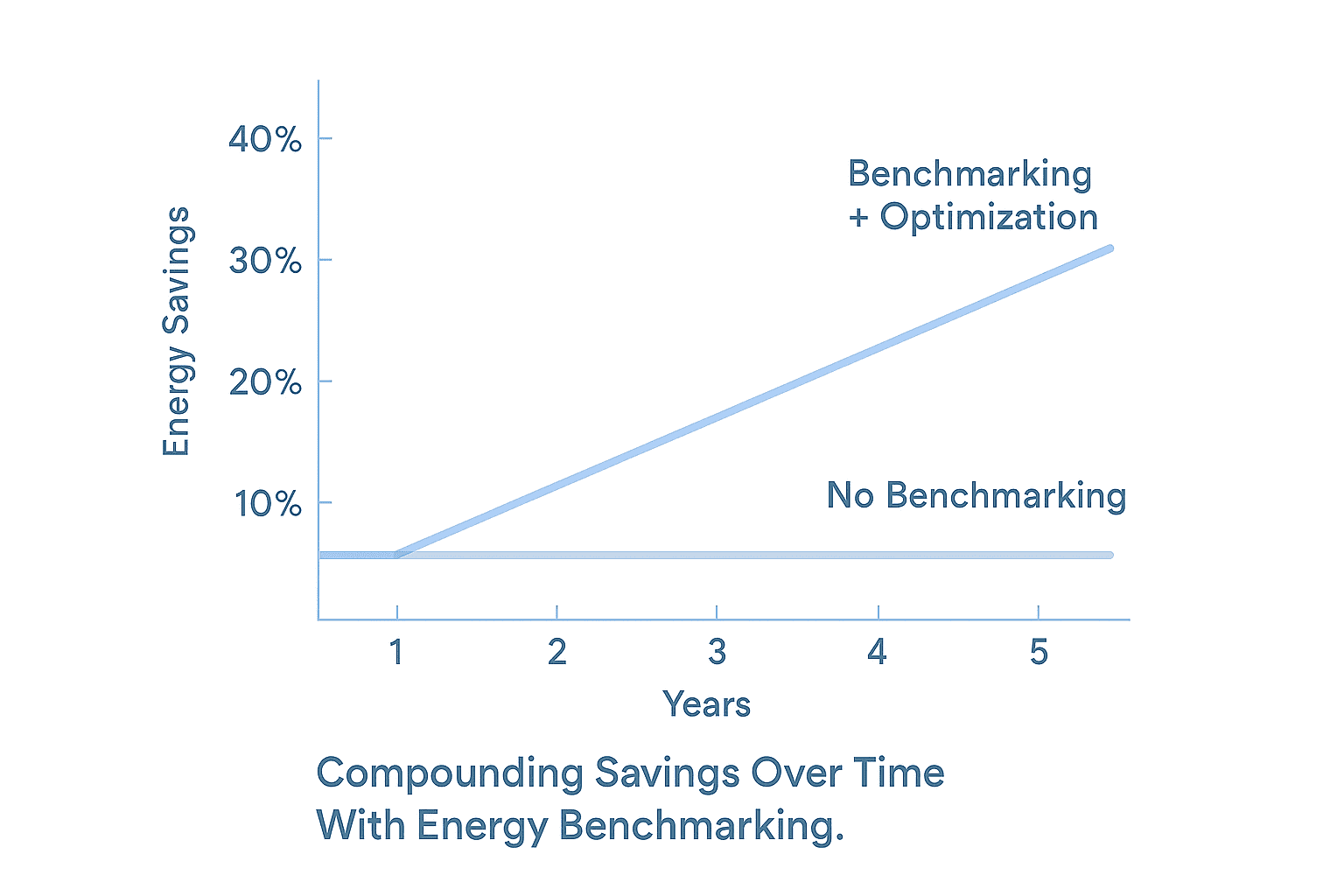

Benchmarking’s ROI is realized when insights lead to cost-saving action. This can eliminate energy waste, implementing low-cost retro-fits, and accessing rebates. According to ENERGY STAR data, buildings that benchmark consistently can reduce energy use by an average of 2.4% per year, with savings compounding over time. Over three years, that can result in a 10–30% reduction in energy costs with proper execution.

Benchmarking ROI In Action: Where The Value Comes From

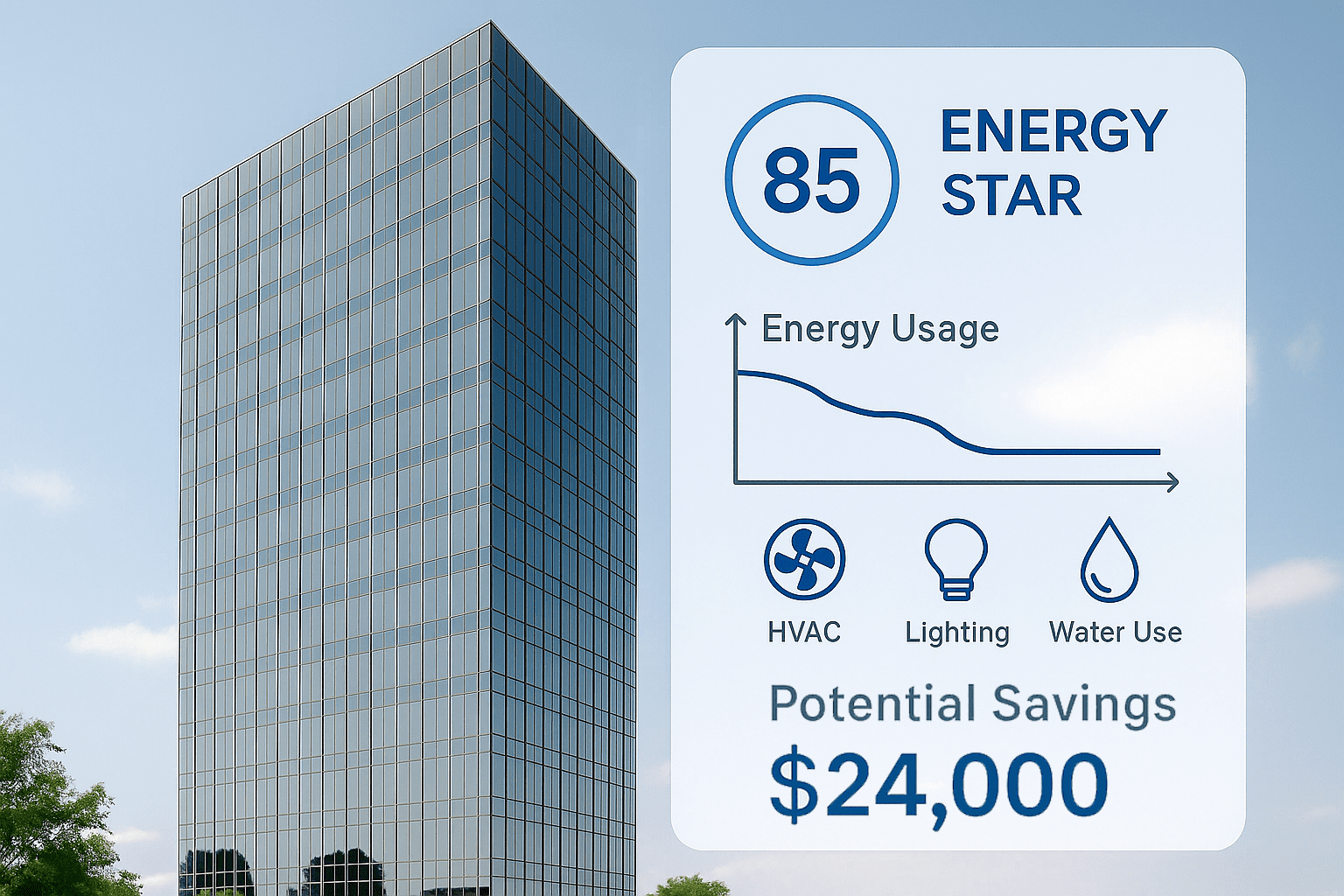

The financial payoff of benchmarking starts with improved energy efficiency. It doesn’t stop there though. It extends to several areas across the building lifecycle. Energy savings from lighting retrofits, HVAC upgrades, and smarter building automation can quickly add up, especially in large or aging facilities. These improvements not only cut utility bills but reduce operational disruptions and extend equipment lifespan.

Higher-performing buildings also tend to retain tenants more effectively. Efficient systems mean fewer comfort complaints, and ENERGY STAR or LEED certifications are increasingly viewed as must-haves in tenant decision-making. Investors also recognize that lower operating expenses directly increase a building’s net operating income (NOI), which can drive higher valuations and resale prices.

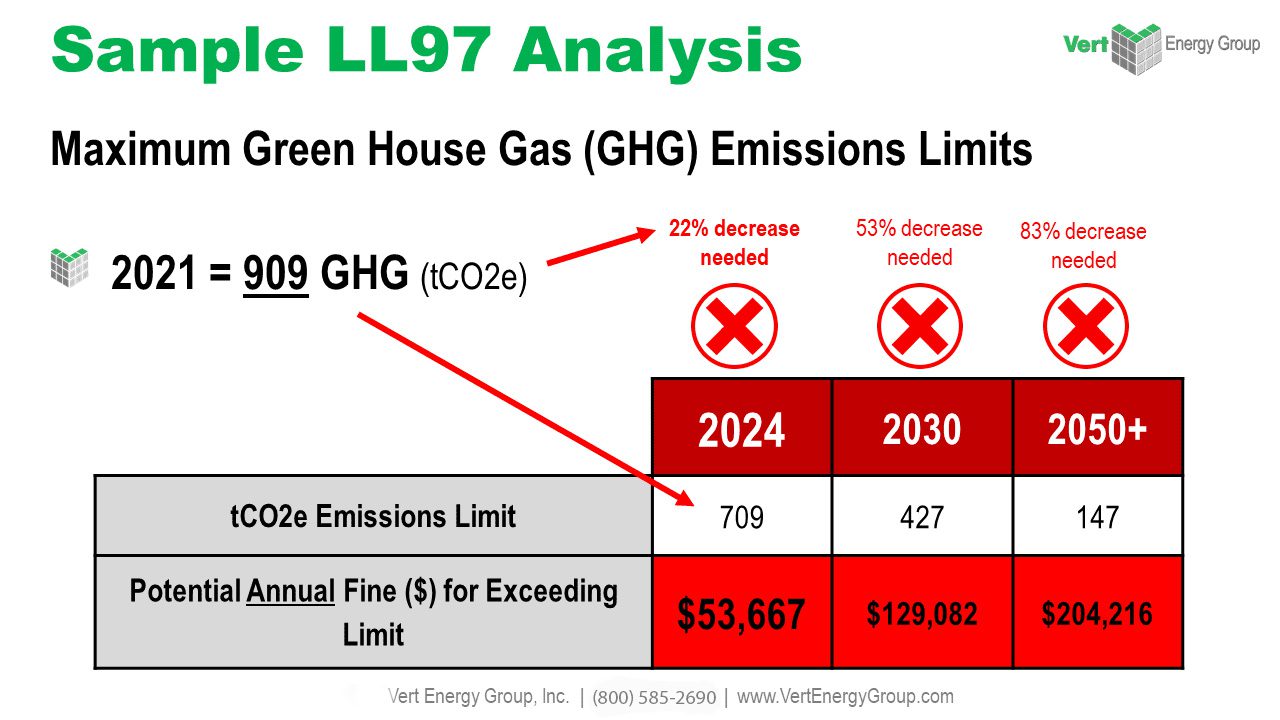

In cities and states with mandatory energy disclosure laws, compliance is another value driver.

Example: The Financial Impact Of Benchmarking

Consider a 100,000-square-foot commercial office building. It has an annual energy spend of $250,000.

Benchmarking reveals inefficiencies that lead to a 15% savings opportunity. If upgrades cost $100,000 to implement, the building would save approximately $37,500 annually on energy. That results in a simple payback period of under three years and an ROI of 100% over 2.66 years. This math doesn’t account for tax incentives, maintenance reductions, or increased asset value.

Why Benchmarking Pays Off Long-Term

Once your benchmarking program is in place, it becomes a powerful tool for ongoing optimization. The data you gather year over year enables smarter decisions, helping you fine-tune your energy use strategy, validate the impact of upgrades, and justify future investments to stakeholders.

Additionally, performance transparency builds trust with tenants, investors, and regulators. Benchmarking supports ESG reporting, BOMA 360, and GRESB participation, allowing your building to compete in the market not just on rent, but on long-term sustainability and efficiency.

By embracing benchmarking as a continuous improvement loop rather than a one-time task, owners unlock stronger cost control and clearer visibility into their building’s performance trajectory.

5 Reasons Why Energy Benchmarking Delivers ROI

- Energy savings accumulate over time, especially when improvements are layered annually.

- Operating costs decrease, directly increasing your NOI and long-term property value.

- Compliance is streamlined, avoiding costly penalties and ensuring regulatory readiness.

- Capital planning becomes smarter, guided by real data instead of guesswork.

- Sustainability targets are easier to track, supporting investor confidence and ESG reporting.

Setting Up for Success: How To Benchmark For Maximum ROI

To ensure you’re getting the most out of your benchmarking strategy, start by setting a baseline. You can do this with ENERGY STAR Portfolio Manager (or VertPro®’s benchmarking platform).

This gives you a clear understanding of your current performance and how you stack up against peers. From there, analyze usage trends to identify peak consumption periods, underperforming systems, or anomalies that suggest inefficiencies.

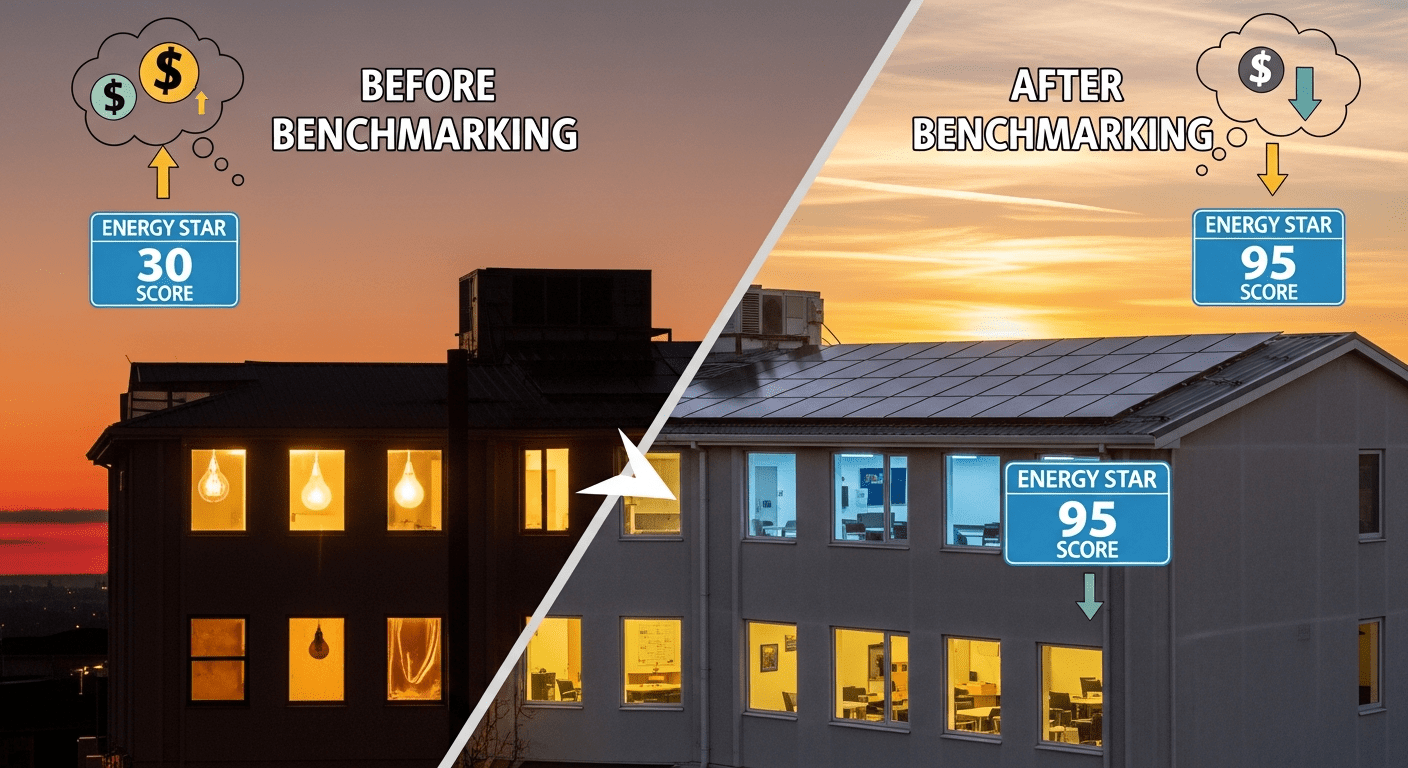

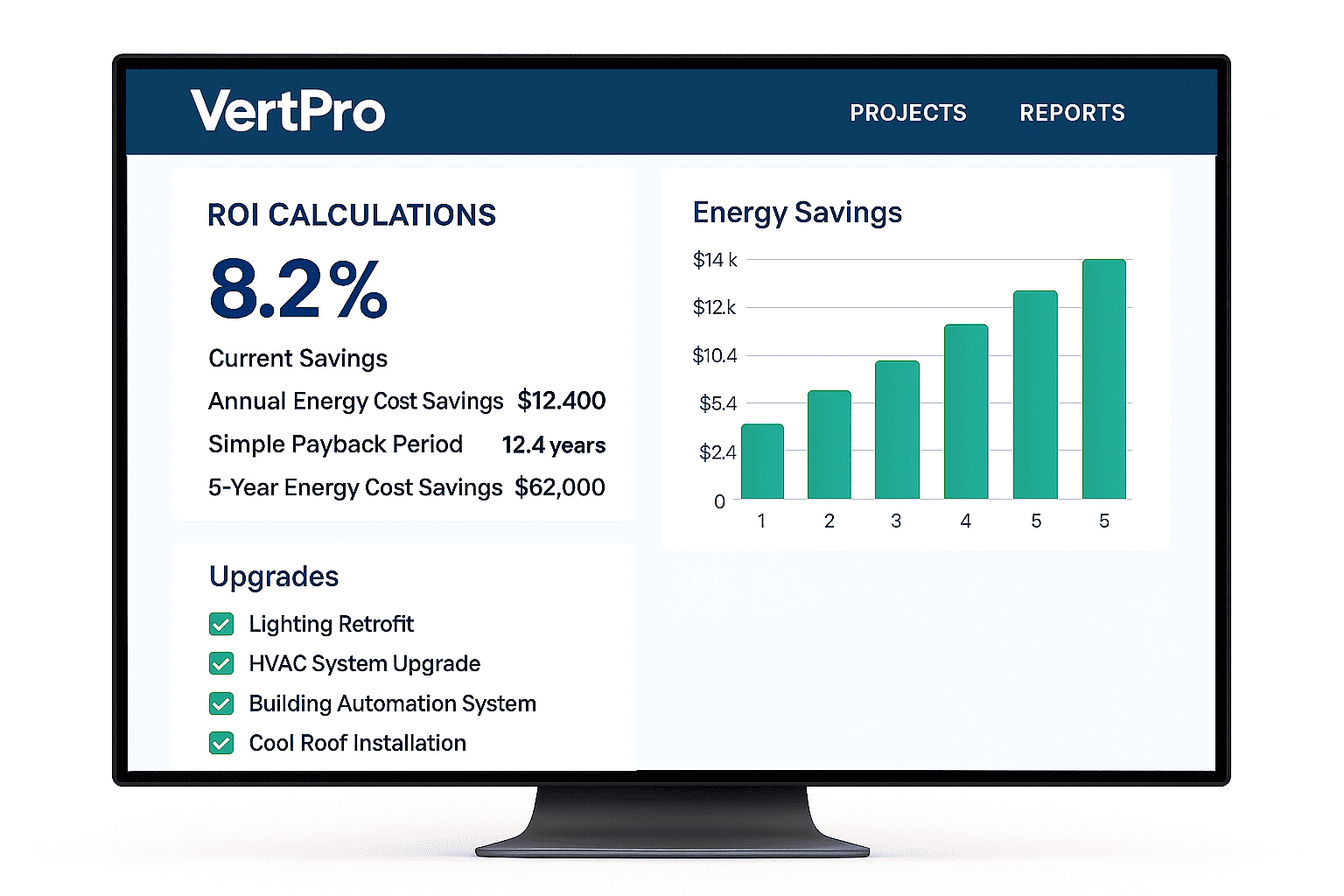

Rather than upgrading everything at once, prioritize projects based on ROI potential. Begin with improvements that have short payback periods, like lighting controls or HVAC scheduling, before moving on to more capital-intensive retrofits. Make sure each project is documented, tracked, and measured post-installation to confirm savings and update your performance score.

For ongoing success, review your benchmarking reports quarterly or semi-annually. Create benchmarks not just for energy use, but also for water, emissions, and operational performance.

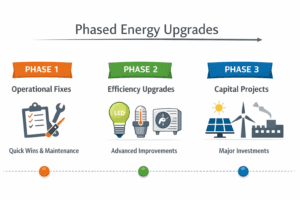

If you manage multiple properties, leverage software that lets you view and compare performance across your portfolio. VertPro®’s tools, for example, help asset managers automate alerts, generate reports, and visualize which buildings are over- or under-performing.

Smart Tech = Better ROI

Technology plays a critical role in maximizing the ROI of benchmarking. Smart meters, IoT sensors, and building automation systems (BAS) give real-time visibility into your energy profile. This allows facility teams to respond quickly when systems drift out of spec, minimizing waste and ensuring savings persist.

Digital audit platforms can also make your benchmarking strategy easier to manage. Rather than tracking compliance deadlines, energy use, and upgrades in scattered spreadsheets, platforms like VertPro® centralize everything, automating documentation, provider coordination, and performance tracking.

Final Thoughts: Benchmarking Is A Smart Business Move

Energy benchmarking delivers more than regulatory peace of mind, it drives real, lasting value. From lowering monthly bills and optimizing operations to supporting sustainability and increasing asset value, benchmarking offers one of the clearest ROI paths in commercial real estate today.

It’s time to shift benchmarking from a “must-do” to a “smart-to-do.” Whether you’re navigating local benchmarking laws, improving ENERGY STAR scores, or preparing for future carbon mandates, benchmarking sets the foundation for success.

Powered by VertPro®

VertPro® helps commercial property owners and managers optimize building performance with technology-driven benchmarking and energy audit solutions. Whether you oversee one property or a nationwide portfolio, VertPro® gives you the tools to:

- Compare building performance

- Streamline compliance with ENERGY STAR, LEED, and city mandates

- Track upgrades and savings

- Visualize your ROI in real time

Start building smarter. Visit VertPro.com to take control of your energy performance today.